The last couple of months have seen the capital markets take a beating and biotech has not been immune from a 10 percent market correction and ongoing unresolved macro-economic issues that have kept Wall Street wary and on edge.

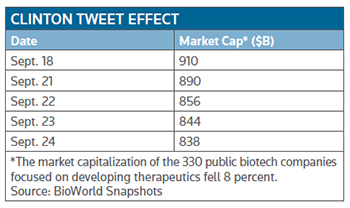

Not surprisingly biotech investors remain a very nervous bunch right now overreacting to any hint of negative news and heading for the hills. This was clearly evidenced last Monday after a tweet from presidential candidate hopeful Hillary Clinton, which essentially said she would take on the issue of rising drug prices, served to tank the biotech sector by over 5 percent by market close. (See Tweet effect table, right.)

Not surprisingly biotech investors remain a very nervous bunch right now overreacting to any hint of negative news and heading for the hills. This was clearly evidenced last Monday after a tweet from presidential candidate hopeful Hillary Clinton, which essentially said she would take on the issue of rising drug prices, served to tank the biotech sector by over 5 percent by market close. (See Tweet effect table, right.)

Her tweet was in response to the fact that Turing Pharmaceuticals AG had hiked the price of Daraprim 5,000 percent after acquiring its U.S. rights from Impax Laboratories Inc. for approximately $55 million. The antiparasitic drug is indicated for the treatment of toxoplasmosis when used conjointly with a sulfonamide. It is also indicated for the treatment of acute malaria in certain patients, and for the treatment of chemoprophylaxis of malaria due to susceptible strains of plasmodia.

The widely reported increase generated mass criticism and Clinton termed it drug-price "gouging" and was the catalyst for her to release a proposal the following day to address the issue of "skyrocketing cost of prescription drugs." (See BioWorld Today, Sept. 23, 2015.)

Analysts were, however, quick to point out that it would be at least two years or more before any legislative oversight took on this issue. However, Evercore ISI analyst Mark Schoenebaum noted that the industry could experience some negative sentiment if drug pricing surfaced as a major issue during the primary campaign.

A RECURRING ISSUE

This is not the first time that politicos have raised concerns about what they perceived as exorbitant pricing of innovative drugs. In the space of just over a year it has hit the sector twice.

Back in March 2014 , Rep. Henry Waxman (D-Calif.) and several Democratic colleagues in Congress, wrote to Gilead Sciences Inc. requesting a briefing to answer questions about the pricing of the company's hepatitis C drug Sovaldi (sofosbuvir). The Waxman letter got a lot of play in the media, triggering a massive sell-off in the biotechnology sector with investors worrying about a possible impending full court press on the costs of innovative new medicines by politicians, regulators and payers alike. (See BioWorld Insight, July 21, 2014.)

As a result, biotech share prices went into a tailspin for a couple of months before stabilizing, and by the end of the second quarter of last year, most public biotech companies had recovered to their "pre-Waxman letter" valuations.

However, just when it looked as though biotech was getting back on track and the issue over Gilead's pricing of blockbuster drug Sovaldi had faded, two members of the U.S. Senate Finance Committee decided that it was time to re-visit the matter. In a letter to Gilead Chairman and CEO John Martin, Sens. Ron Wyden (D-Ore.), chairman of the finance committee, and committee member Chuck Grassley (R-Iowa) said it was "unclear" how the firm set the price for Sovaldi and asked for a "better understanding of how your company arrived at the price for this drug," citing the impact to federal health care spending, including costs to Medicare and Medicaid. The senators said health care experts estimated that the price could contribute to an additional $2 billion in costs to Medicare for prescription drugs between 2014 and 2015 if 25,000 patients enrolled in the Part D program. (See BioWorld Today, July 14, 2014.)

Although, at the time, the communication didn't cause too many market waves, it transpired on the heels of a comment made by Janet Yellen, the chair of the Federal Reserve, noting "valuation metrics in some sectors do appear substantially stretched – particularly those for smaller firms in the social media and biotechnology industries, despite a notable downturn in equity prices for such firms early in the year."

It was enough to put the biotech industry into a tailspin once again before it eventually recovered to record new highs by year-end.

Fast forward to today and biotech faces similar headwinds. Not only does it have to contend with the prevailing uncertain financial markets, but execs are faced with defending the industry from a potential ongoing debate on drug pricing during the election season.

Will the sector be able to recover a third time? Despite its recent downturn in value the BioWorld Blue Chip Biotech Index remains in positive territory year-to-date, up almost 9 percent, but at market close last Thursday was down almost 12 percent for the quarter and it dropped 8 percent in the four day period following Clinton's tweet. With the markets predicted to be turbulent for the rest of the year, biotech could face the prospect of recording its first losing year since 2010.

Editor's note: Our detailed review of the performance of the biotech sector in the third quarter will be published next week.