As the day went on and Wall Street heard further details, out-of-the-gate skepticism calmed among onlookers about the $14 billion price tag on Pfizer Inc.'s buyout of Medivation Inc.

Pfizer CEO Ian Read called the bidding process "efficient and competitive," adding that his firm "paid a fair price" at $81.50 per share in cash for Medivation. Just last year, New York-based Pfizer agreed to fork over $17 billion for Hospira Inc., of Lake Forest, Ill. Asked about further M&A post-Medivation, Read said, "I think we have moved into a more balanced view now." (See BioWorld Today, Feb. 6, 2015.)

Morningstar analyst Damien Conover noted that, "pricing power has eroded in several therapeutic areas [but] cancer drugs have continued to support robust prices." Offers from the likes of Paris-based Sanofi SA probably pushed amounts higher in the auction and led to the win by Pfizer, which brings aboard androgen receptor inhibitor Xtandi (enzalutamide) for metastatic, castration-resistant prostate cancer that has spread or recurred, even with medical or surgical therapy to block testosterone. Also in the hopper is phase III poly ADP-ribose polymerase (PARP) inhibitor talazoparib.

Read said it's too early to talk about how much of the acquired firm's management Pfizer might keep. "Clearly, we are interested in retaining the best talent from Medivation that we can," he said. "They've been very successful in their development plans."

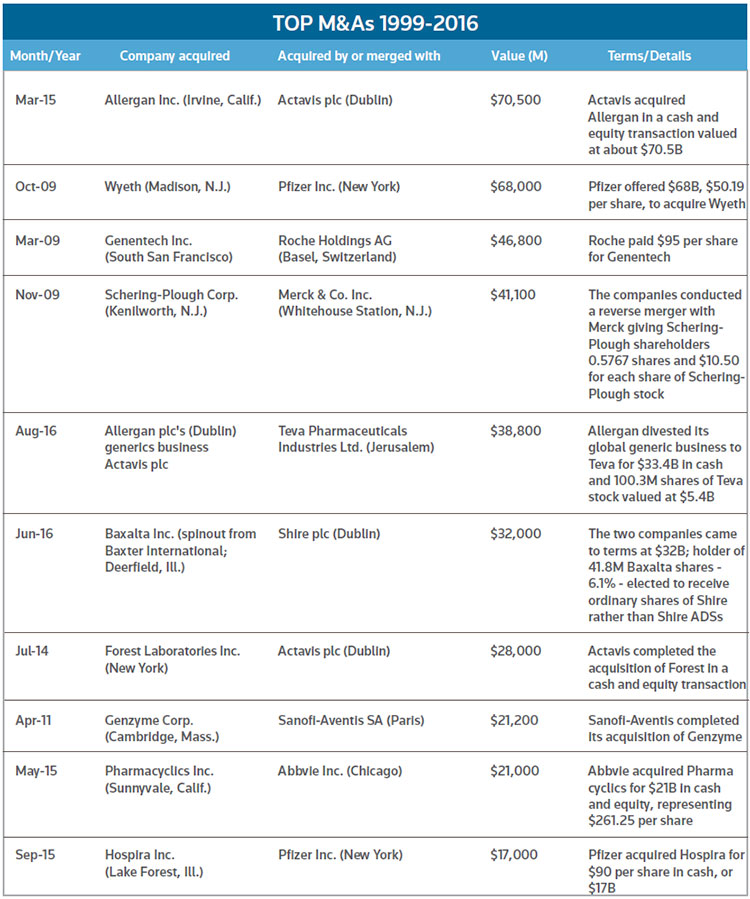

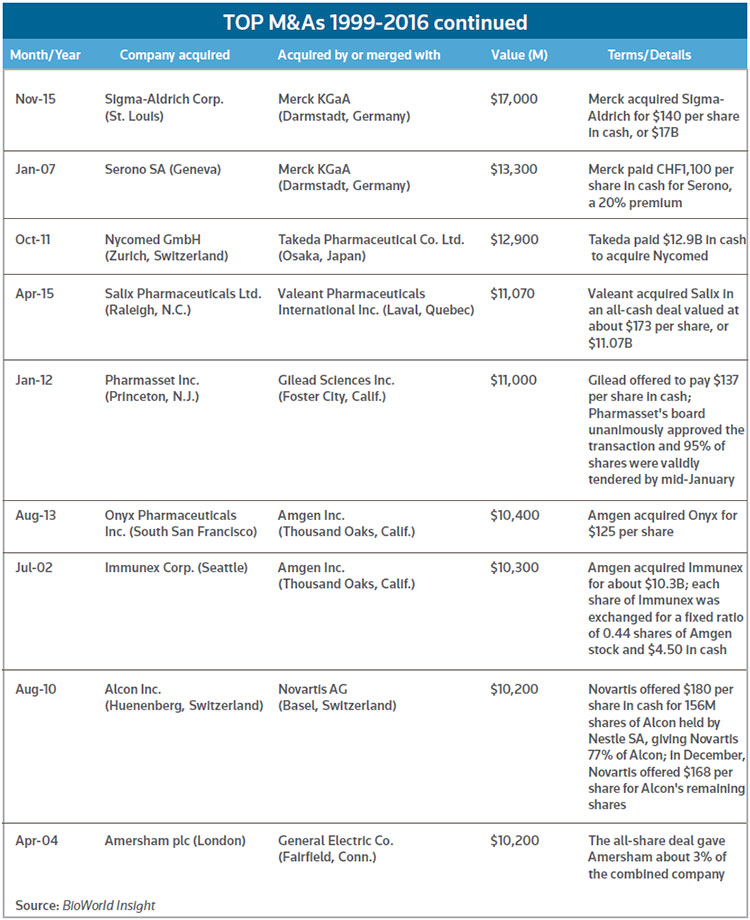

The push by Pfizer to take over Medivation, of San Francisco, may not have surprised many observers, given the past relationship of the companies. In 2008, Pfizer agreed to pay $225 million up front plus $500 million in potential milestone payments in to co-develop and market Dimebon, Medivation's candidate for Alzheimer's and Huntington's diseases. About 19 months later, Dimebon failed in a phase III trial, and the arrangement dissolved early in 2012. Medivation, though, was able to use the funds gained in the Dimebon deal to help finance development of Xtandi, which won approval later the same year that the Dimebon pact went away. Xtandi sold about $2.2 billion worldwide over the past four quarters. Pfizer said bringing Medivation into the fold would become immediately accretive to adjusted, diluted earnings per share upon closing, to the tune of 5 cents per share for the first full year with more afterward. The deal is one of the bigger M&As in recent years. (See chart, below.) (See BioWorld Today, Sept. 4, 2008, March 4, 2010, and Sept. 4, 2012.)

U.S. revenues from Xtandi are split by Medivation with partner Astellas Pharma Inc., of Tokyo. In 2009, Astellas paid Medivation $110 million up front for rights to Xtandi (previously called MDV3100), with up to another $655 million promised if goals were met – $335 million in pre-commercial and $320 million in post-commercial milestones – as well as 50 percent of U.S. profits and tiered double-digit royalties on ex-U.S. sales. Partly because of the split, RBC Capital Markets analyst Simos Simeonidis said in a report that that he had "a very difficult time getting to" the price Pfizer is paying, "based on reasonable modeling assumptions for the company."

OTHERS ON WOULD-BE TAKEOUT LIST

Simeonidis characterized the all-cash deal as "surprising, given the risk involved in second asset talazoparib and a credit to Medivation's management, which may manage to sell this asset, without any or much of a contingent value right [if that indeed ends up being the case]," given that talazoparib's phase III data are due soon. The PARP inhibitor, undergoing pivotal work against BRCA-positive breast cancer, has been described as a "multibillion-dollar opportunity" by Medivation, and the study called EMBRACA is expected to report data in the first half of next year, though the company has said the readout could happen sooner. Simeonidis pegged the chance of Sanofi making another try for Medivation at 15-20 percent, and deemed it "very unlikely" another bidder will crop up. (See BioWorld Today, Oct. 28, 2009, Sept. 13, 2010, and July 8, 2016.)

On a conference call with Pfizer regarding the deal, Leerink analyst Seamus Fernandez wanted to know "your view on how broad you think the PARP opportunity actually is – whether it be purely germline BRCA type opportunity, as well as the already pursued prostate cancer opportunity? Or do you see that DNA damage-response opportunity as particularly broader, and if so, what are the key target tumor types that you are most interested in exploring?"

CEO Read cited "a scientific boom around understanding the impact of DNA repair deficiency in tumors," along with the talazoparib opportunity in BRCA breast cancers. He said Pfizer was "able to review studies in combination with chemotherapy" that suggest further potential. "We see opportunities to study DNA repair deficiency in ovarian cancer [and] in prostate cancer. Obviously, in those areas there are multiple Pfizer drugs" that might lend themselves to combo therapy with talazoparib, he said.

Xtandi remains the star for Medivation, and Brean Capital analyst Jonathan Aschoff predicted Pfizer "will further expand the commercial scale by not just adding more bodies to the sales force, but also driving urologists' adoption [thanks to] its deep relationship with these doctors." Xtandi already holds 51 percent of market share in the novel hormonal therapy market and "has clinically outpaced the alternatives," he wrote in a report, doubting that CVS Caremark's decision to leave Xtandi out of its main 2017 formulary will have much impact. Pfizer "will work with physicians and patients on availability, and Xtandi's highly differentiated clinical profile should continue to support prescription," he said.

Jefferies analyst Jeffrey Holford was not surprised to see Pfizer win Medivation and called the pairing "a logical fit. Investors should remember that Pfizer has clearly flagged potential use of cash for M&A, and we see the current low interest rate environment as being a strong facilitator" for such deals, he wrote in a report.

Holford's peer at Jefferies, Brian Abrahams, posited that "we may be heading into deal-making season," and pointed out that M&A activity tends to rise near the end of summer. "Even though the number of deals made in 2016 has been modest, premiums paid through acquisition have remained strong (average 75 percent premium to pre-takeout 30-day average trading price), with the Pfizer-Medivation deal being no exception." Jefferies predicted in January that volatility would wane in the second half of this year, and forecasted further that "M&A would re-accelerate and catalyze the sector, given the strong strategic incentive for large-cap biotech and pharma companies to bring in additional assets through acquisitions." Maybe that trend is playing out. Other firms that could be takeout candidates, in his view, include Gilead Sciences Inc., Celgene Corp., Vertex Pharmaceuticals Inc., Incyte Corp. and Alder Biopharmaceuticals Inc.

Shares of Medivation (NASDAQ:MDVN) closed Monday at $80.42, up $13.26, or 19.7 percent. Pfizer (NYSE:PFE) ended at $34.84, down 14 cents.