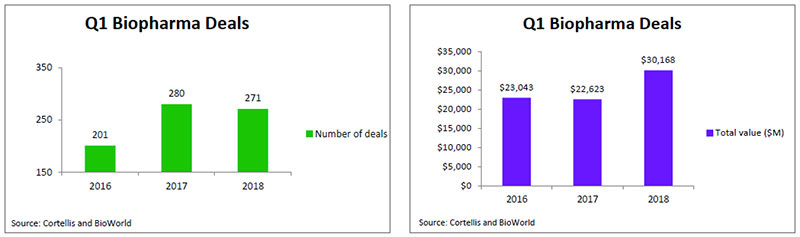

Despite the fact that the industry inked more than 1,000 deals last year, it appears that biopharma companies are not losing their appetite for dealmaking. According to data from BioWorld and Cortellis Deals Intelligence, there were 271 deals signed in the first quarter of 2018, on par with 2017 first quarter transactions. However, the total value of those deals topped $30 billion, which is 33 percent higher than last year's total, reflecting that it has become a seller's market with competition for biotech assets driving up their price. (See Q1 Biopharma Deals, below.)

Oncology space still hot

It is no surprise that partnerships involving cancer assets dominated the transaction landscape at approximately 37 percent of the total in the quarter. In terms of value, cancer-related deals also garnered just over 50 percent at $15 billion. (See Number and Value of Biopharma 2018 Deals by Therapeutic Focus, below.)

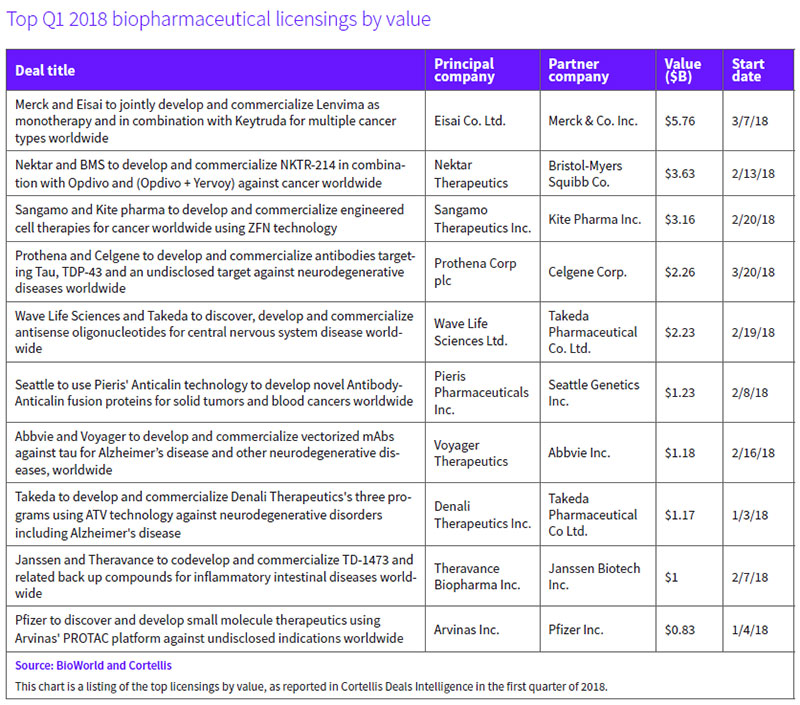

A new joint development program testing Eisai Co. Ltd.'s Lenvima (lenvatinib mesylate), an oral tyrosine kinase inhibitor, both alone and together with Merck & Co. Inc.'s anti-PD-1 therapy, Keytruda (pembrolizumab), across a dozen cancers ranked as the top deal in terms of value.

Their agreement covering 11 potential indications across six cancer types could yield up-front, option and regulatory and sales milestone payments that total up to $5.76 billion assuming across-the-board success. The payments include $300 million for Eisai up front and up to $650 million for certain option rights, as well as $450 million in reimbursement for R&D expenses. The partners will share profits equally, including from sales of Lenvima for currently approved indications. (See BioWorld, March 14, 2018.)

Nektar Therapeutics Inc.'s potential $3.63 billion immuno-oncology (I-O) deal with Bristol-Myers Squibb Co. (BMS), ranked second. The alliance, involving NKTR-214, provides Nektar with $1.85 billion up front – $1 billion in cash and the remainder through an $850 million purchase of approximately 8.28 million Nektar shares.

The companies will evaluate NKTR-214, which binds to the CD122 receptor on the surface of CD8-positive and CD4-positive immune cells, with Opdivo (nivolumab) or Opdivo plus Yervoy (ipilimumab) in registration-enabling trials in more than 20 indications across nine tumor types. BMS obtained exclusive rights in the indications included in the joint development plan for a specified time period. Targeted indications include melanoma and renal cell carcinoma, for which pivotal trials of the combination approach are expected to start midyear, along with non-small-cell lung cancer, bladder and triple-negative breast cancers. (See BioWorld, Feb. 15, 2018.)

Another significant cancer deal claimed the third spot in the value rankings table. (See Top Q1 2018 biopharmaceutical licensings by value, below.)

Sangamo Therapeutics Inc. signed a potential $3 billion-plus deal with Gilead Sciences Inc.'s Kite Pharma unit, which is designed to exploit Sangamo's zinc finger nuclease (ZFN) platform for the development of next-generation ex vivo cell therapies in cancer. Kite will utilize ZFN to modify genes and develop new cell therapies for autologous and allogeneic approaches. (See BioWorld, Feb. 23, 2018.)

Under the terms, Sangamo collected an up-front payment of $150 million and is eligible for as much as another $3.01 billion, calculated across 10 or more products deploying ZFN and based on reaching research, development, regulatory and commercialization goals. Downstream, Sangamo could receive tiered royalties, with Kite responsible for development, manufacturing and commercialization.

Neurodegenerative diseases

Late-stage trial flops in Alzheimer's disease and the still large areas of uncharted waters in the central nervous system hasn't served to dampen the enthusiasm of biopharma companies looking to pioneer novel therapies in the space. As a result, 29 deals, encompassing nearly $8 billion in transactional value, were inked in the quarter.

A marquee $2.2 billion deal involved Prothena Corp. and Celgene Corp. Dublin-based Prothena received $100 million up front and a $50 million equity investment in the collaboration, which focuses on three proteins, including tau, a cleaved form of TAR DNA-binding protein 43 (TDP-43), and an undisclosed target. In return, Celgene gains an exclusive right to license clinical candidates in the U.S. at the time of IND filing and, if it does so, could expand the license to global rights at the end of phase I trials. If the option is exercised, Prothena will collect approximately $80 million for each program. Celgene would then have decision-making authority over development activities, and all regulatory, manufacturing and commercialization efforts for antibody products targeting the relevant target. An additional exercise fee of $55 million per program is built into the deal that covers the eventuality of Celgene picking up worldwide rights. (See BioWorld, March 22, 2018.)

Wave Life Sciences Ltd.'s pact with Japan-based Takeda Pharmaceutical Co. Ltd. could unlock more than $2 billion in value, including the $110 million up-front payment and $60 million equity investment. The pair will work on discovering, developing and commercializing nucleic acid therapies for CNS disorders.

Takeda receives the option to co-develop and co-commercialize programs in Huntington's disease, amyotrophic lateral sclerosis, frontotemporal dementia and spinocerebellar ataxia type 3, along with the right to license multiple preclinical programs targeting CNS disorders that include Alzheimer's disease and Parkinson's disease. For each program into which Takeda opts, Wave will collect an undisclosed payment and will lead manufacturing as well as joint clinical co-development for each. Takeda will lead joint co-commercial activities in the U.S. and all ex-U.S. commercial efforts. Global costs and potential profits will be split evenly, with Wave in line for development and commercial milestone payments. (See BioWorld, Feb. 23, 2018.)

M&A's top of mind

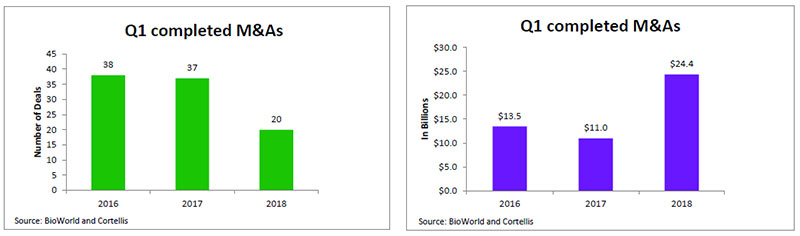

The rocky start that public biopharma companies have experienced so far this year has served to keep investors on the sidelines. Most analysts believe that the sector needs to get more involved in business development with companies drawing on their bulging bank balances to acquire assets to improve their bottom lines. The call for more M&A deals, however, appears to have gone unheeded with the number of transactions dropping 45 percent over last year's total at this time. (See Q1 2018 M&A deals, below.)

The value of those acquisitions totaled $24.4 billion compared to the $11 billion in Q1 2017, thanks to Sanofi SA's acquisition of Bioverativ Inc. for $11.6 billion and Celgene's $9 billion acquisition of Juno Therapeutics Inc. (See BioWorld, Jan. 23, 2018.)

That megadeal in the white hot immuno-oncology space, which positions Celgene as a leading cellular immunotherapy company, has not so far acted as a catalyst for an M&A bonanza.

Perhaps last week's news in the other hot technology area of gene therapy will do the trick. The transaction involves Novartis AG coming in with an $8.7 billion offer to buy Chicago-based Avexis Inc., a company developing a gene therapy for spinal muscular atrophy (SMA). (See BioWorld, April 10, 2018.)

Novartis estimates there are about 23,500 patients with various types of SMA in established markets worldwide, and AVXS-101, Avexis' lead asset, now in pivotal testing for the treatment of the severe muscle movement disorder SMA type 1, could, therefore, become a blockbuster therapy for the monogenic disease.