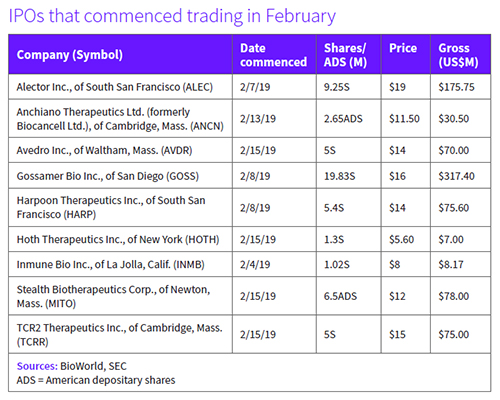

Not long after January's sharp rebound of the BioWorld Biopharmaceutical Index, a quartet of new companies is moving to join the public market, led by sizable offerings priced by mitochondrial dysfunction-focused Stealth Biotherapeutics Inc., which is raising $78 million, and corneal remodeling company Avedro Inc. with its $70 million offering. Alongside them, eczema specialist Hoth Therapeutics Inc. priced a small $7 million IPO and cancer drug developer Anchiano Therapeutics Ltd. closed a $30.5 million offering. Taken together with five other Nasdaq joiners, the moves raise February 2019's total IPO sum to $837.4 million, the most raised for a February since 2000, according to BioWorld data.

Despite the brisk momentum, none of last week's offerings exceeded expectations, and only one got off to a relatively strong start.

American Depository Shares (NASDAQ:MITO) of Stealth, a Cayman Islands company that runs its Newton, Mass.-based business through a subsidiary, started trading Friday at $12 before closing at $11.90. The company initially filed in December 2018 to raise up to $86.25 million but later pared its offering back, pricing 6.5 million ADSs at the low end of a contemplated $12 to $14 range to raise $78 million.

Morningside Venture Investments, the company's principal shareholder before the offering, committed to buying about $60 million of the ADSs in the IPO, suggesting an expectation for only modest outside demand. Jefferies LLC, Evercore Group LLC. and BMO Capital Markets Corp. are acting as joint book-running managers for the offering.

Stealth is focused on developing therapies for diseases involving mitochondrial dysfunction. In December, the FDA granted fast track designation for its lead investigational candidate, elamipretide, for the treatment of dry age-related macular degeneration with geographic atrophy. It is also studying elamipretide for the treatment of primary mitochondrial myopathy, Barth syndrome and Leber's hereditary optic neuropathy.

Avedro Inc., a Waltham, Mass.-based company that's using ultraviolet A light and a suite of single-use riboflavin drug formulations in its corneal remodeling platform, met an even cooler reception out the gate. Almost immediately after pricing its offering of 5 million shares at $14 per share, the company's shares (NASDAQ:AVDR) fell to a $12.29 close on Thursday, sliding even lower before regaining some ground to close at $12.35 close on Friday.

Avedro uses its platform technology to strengthen, stabilize and reshape patient corneas using corneal cross-linking to treat conditions caused by changes in the shape of the eye that prevent light from focusing on the retina, causing blurred vision. As explained in its filing, the product is designed to "increase the collagen cross linking by using riboflavin in treatment of keratoconus by causing the collagen fibrils to thicken, stiffen and cross link and reattach to each other making the cornea stronger, more stable and in turn halting the disease progression."

The company recorded revenue of $27.5 million and $27.7 million in 2018 vs. $20.2 million in 2017, an increase it attributed in part to increased drug revenue in the U.S. due to an increase in the average selling price of single-use riboflavin drug formulations sold.

Cambridge, Mass.-based Anchiano Therapeutics Ltd., formerly known as Biocancell Therapeutics Inc., also saw a hard landing during its debut. Following early plans to raise up to $40.2 million through an offering of 2.4 million ADSs, the company went through a recalibration to arrive at a more modest target in an IPO of about 2.7 million ADSs priced at $11.50 each, brining in $30.5 million at the offering's close. By Friday's close, company ADSs (NASDAQ:ANCN) had fallen to $9.30 each. Oppenheimer & Co. Inc. acted as the sole book-running manager for the offering.

Anchiano is working on a targeted gene therapy to improve the standard treatment for early stage bladder cancer. Proceeds from the offering were expected to meet the company's capital needs for the next one-and-a-half years, the company said.

Finally, thinking small, New York -based Hoth Therapeutics Inc. at least partially bucked the trend. After initially contemplating an IPO intended to raise $13 million through a sale of about 1.8 shares priced between $5.50 and $6.50 each, it settled on a 1.3 million shares priced at $5.60 each. Despite the pullback, the company's shares received a relatively warm welcome from investors, which drove shares (NASDAQ:HOTH) up 52.3 percent to $8.53 on Friday.

Hoth is working on two different topical creams, one intended to treat eczema and another designed to reduce post-procedure infections, accelerate healing and improve clinical outcomes for patients undergoing aesthetic dermatology procedures.

Other companies that commenced trading this month include Alector Inc., TCR2 Therapeutics Inc., Gossamer Bio Inc., Harpoon Therapeutics Inc., and Inmune Bio Inc. Three of the five have seen their shares secure gains since their debuts. TCR2 and Inmune have experienced dips below their initial offering prices.