Keeping with the trend of high-value biopharma deals, the second quarter of 2019 logged another eight partnerships worth $1 billion or more, with Gilead Sciences Inc. a party to three of them.

Added to those tracked by BioWorld in the first quarter, the year currently has 17 completed deals that have risen above the threshold, many of which are focused on early stage drug discovery and development.

"Once again we're seeing a lot of billion-dollar deals and they tend to be preclinical-stage deals that have multiple assets," said David Thomas, vice president of industry research and analysis for the Biotechnology Innovation Organization. "It's a trend that started in 2016."

Thomas spoke in June at BIO's annual convention in Philadelphia, and the organization recently published the 2019 Emerging Therapeutic Company Trend Report, which showed that the number of global R&D-stage licensing deals surged by 107% in 2018 over the prior year.

While BioWorld casts a wider net in deal-gathering, Thomas said that the 12 $1 billion-plus deals tracked by BIO so far in 2019 compare with 28 in 2018, rising from only four in 2015.

BioWorld numbers show that a total of 33 deals hit $1 billion and above in 2018, compared with 23 in 2017 and 19 in 2016.

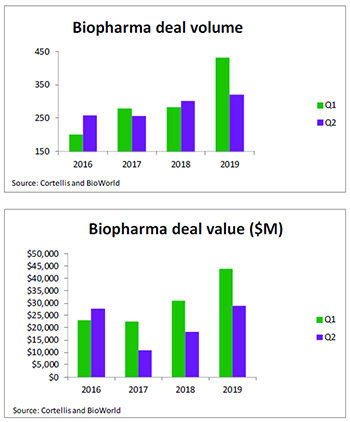

Furthermore, the second quarter of 2019 appears to be the best second quarter in the last four years in terms of both volume and value (321 deals worth $28.9 billion), but it is showing a significant drop from the first quarter by about 25% (from 431 deals) and 34% (from $43.88 billion), respectively. (See Biopharma deal volume and value charts, right.)

Furthermore, the second quarter of 2019 appears to be the best second quarter in the last four years in terms of both volume and value (321 deals worth $28.9 billion), but it is showing a significant drop from the first quarter by about 25% (from 431 deals) and 34% (from $43.88 billion), respectively. (See Biopharma deal volume and value charts, right.)

Nevertheless, Gilead Sciences completed three large deals worth $2.345 billion with Nurix Inc. in June for E3 ligase modulating targeted protein degradation drugs for cancer and other diseases, $2.06 billion with Goldfinch Bio Inc. in May for new therapies for diabetic kidney disease and orphan kidney disease, and $1.05 billion with machine learning company Insitro in April for therapies to treat nonalcoholic steatohepatitis. Those deals were added to Gilead's $785 million NASH partnership with Yuhan Corp. in January and a $470 million immuno-oncology deal with Carna Biosciences Inc. in June, on top of some other activity with Novo Nordisk A/S, Abcellera Biologics Inc. and Hitgen Ltd. involving undisclosed amounts.

The largest deal of the quarter occurred between two large pharmas in May when Novartis AG acquired worldwide rights to Takeda Pharmaceutical Co. Ltd.'s Xiidra for dry eye disease for $5.3 billion. Other large deals of the second quarter include a partnership between Regeneron Pharmaceuticals Inc. and Alnylam Pharmaceuticals Inc. worth $1.435 billion to discover, develop and commercialize RNAi therapeutics for ocular and central nervous system diseases, a $1.07 billion agreement between Vertex Pharmaceuticals Inc. and Kymera Therapeutics LLC to discover and develop small-molecule protein degraders using Pegasus drug discovery platform, a $1.01 billion deal for Cytovant Sciences HK Ltd. to develop and commercialize Medigene AG's T-cell immunotherapies, including NY-ESO-1, DC vaccine and T-cell receptors for two additional targets, and Vertex Pharmaceuticals Inc.'s $1 billion deal with Crispr Therapeutics AG for gene editing products for Duchenne muscular dystrophy and myotonic dystrophy type 1.

Looking forward "we're probably going to see the rare disease and cancer space an area of focus for acquisitions," Thomas said.

Neel Patel, managing director of portfolio and commercial strategy at Syneos Health, said there are a large supply of oncology and neurology assets, but "areas where there's quite a bit of demand and fewer assets available are hepatic diseases, inflammation and hematology."

An analysis of the 48,500 partnering meetings held at the BIO convention this year indicated, when looking only at the top 30 biopharma companies with 15 or more high-level meetings scheduled, an interest in the inflammatory area, microbiome companies, novel nucleic acid platforms, new ways to design small molecules by computer, epigenetics, delivery technologies, Alzheimer's disease and immuno-oncology, Thomas said.

"Oncology, in particular, we've showed previously that there's a huge amount of buyer demand," Patel said, "but it's completely eclipsed by the sheer volume of assets that are available. This is across all phases of development."

Big money M&As pending

The BIO emerging trends report said that global R&D-stage emerging therapeutic company acquisitions rebounded in 2018, with a record $32.5 billion paid up front for 28 companies – 66% of which were U.S. based. On the other hand, the number of market-stage company acquisitions hit a decade low.

BioWorld figures show a higher volume of completed M&As in 2019's second quarter in comparison to second quarters within the last few years, but the M&A value is down – most significantly in comparison to the first quarter of this year, which included the $62.32 billion acquisition of Shire plc by Takeda Pharmaceutical Co. Ltd. Once removed, however, the two quarters are more even, with a first-quarter value of $17.9 billion ($80.2 billion with Shire/Takeda) and a second-quarter value of $15.2 billion. (See Biopharma M&A volume and value charts, right.)

BioWorld figures show a higher volume of completed M&As in 2019's second quarter in comparison to second quarters within the last few years, but the M&A value is down – most significantly in comparison to the first quarter of this year, which included the $62.32 billion acquisition of Shire plc by Takeda Pharmaceutical Co. Ltd. Once removed, however, the two quarters are more even, with a first-quarter value of $17.9 billion ($80.2 billion with Shire/Takeda) and a second-quarter value of $15.2 billion. (See Biopharma M&A volume and value charts, right.)

Most recently, Abbvie Inc. set out to acquire Allergan plc in a $63 billion deal expected to close in early 2020. The deal, one of the largest in history, came as a surprise to many analysts, and follows the $74 billion January offer by Bristol-Myers Squibb Co. to buyout Celgene Corp.

"While take-out of the largest specialty pharma company may provide a sentiment lift, we see little fundamental read-through or support for further consolidation within the sector," wrote analyst Randall Stanicky, of RBC Capital Markets. "On a larger scale, this follows BMY/CELG and is likely to pivot focus to who else has P&L holes to fill in large pharma/bio and possible targets."

"Despite this landmark acquisition, which showcases the attractiveness of the aesthetics business, we believe there are limited read-throughs to other companies in specialty pharma," said analyst David Steinberg, of Jefferies. "Rather than a focus on a specific market/pipeline product or technology, this transaction has more to do with attaining scale, critical mass, cash flow and reasonable durability – which few companies in the sector offer."

Other large M&As on BioWorld's pending list include Roche Holding AG's purchase of Spark Therapeutics LLC for $4.8 billion, Merck & Co. Inc.'s offer to buy Peloton Therapeutics Inc. for $1.05 billion, and Pfizer Inc.'s takeover of Array Biopharma Inc. for $11.4 billion. The Peloton and Array acquisitions were announced in the second quarter.

As for those completed in the second quarter, Ipsen SA's buyout of Clementia Pharmaceuticals Inc. for $1.3 billion and Novartis AG's purchase of IFM Tre for $1.58 billion are among the biggest. Three others involved companies working with gene transfer technologies: Thermo Fisher Scientific Inc.'s $1.7 billion acquisition of Brammer Biopharmaceuticals LLC, Catalent Inc.'s $1.2 billion purchase of Paragon Bioservices Inc., and Biogen Inc. subsidiary Tungsten Bidco Ltd's $800 million takeover of Nightstar Therapeutics plc.

Overall, 2019 appears to be a strong year, although not quite as strong as 2018, Patel said.

"There are a lot of challenges in our industry," he said, "just the pure scientific and regulatory risk of getting to market, but it's also equally difficult to get a deal done. Buyers are looking at tons of opportunities." (See Top Q2 2019 biopharmaceutical licensings by value, below.)