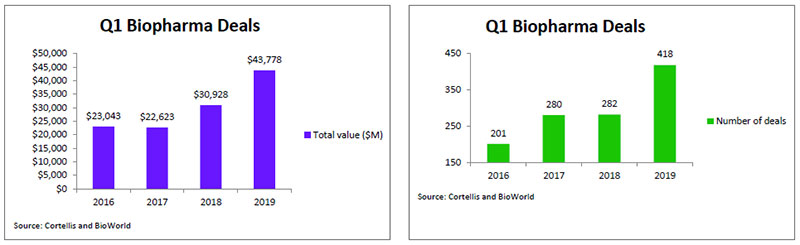

Although the number of biopharma licensing deals signed in 2018 reached 1,364 with a projected value of $119.5 billion, a four-year high, it appears that number has not satisfied the industry's appetite for dealmaking just yet. According to data from BioWorld and Cortellis Deals Intelligence, there were 418 deals signed in the first quarter of 2019, a whopping 48% higher than the first quarter transactions completed last year. The total value of those deals reached almost $43.8 billion, which is 41% higher than last year's total, reflecting the fact that the intense competition for biotech assets is continuing to drive up their value. (See Q1 Biopharma Deals by Number and Value, below.)

Potential $1B pacts

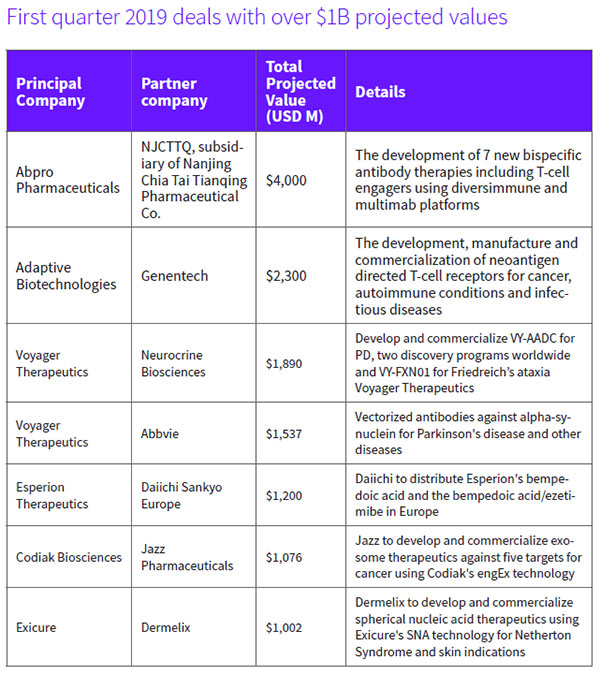

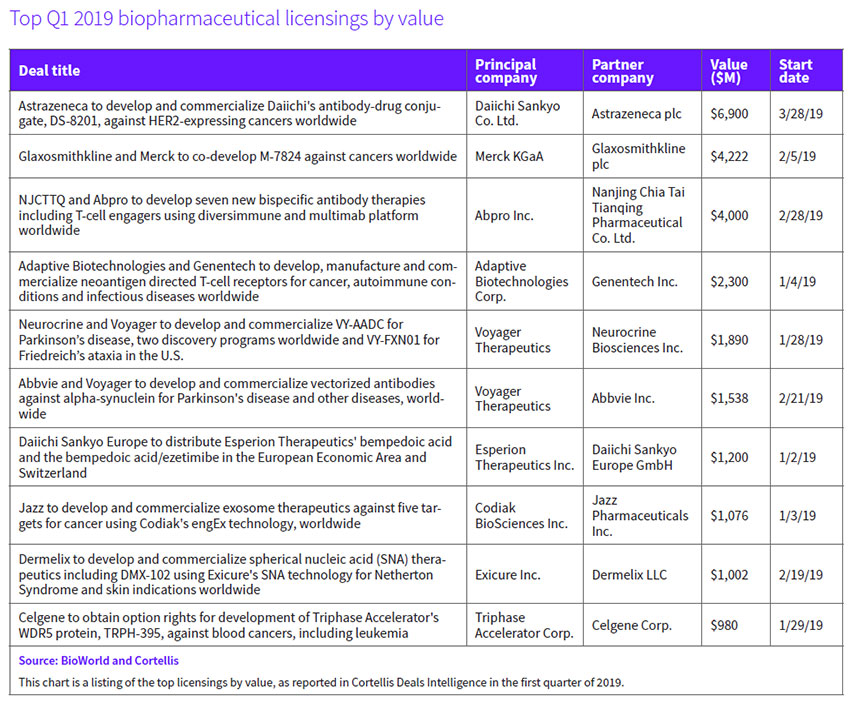

Taking into account deal values that include up-front payments, equity investments and future downstream milestones, the first quarter recorded seven transactions that had values in excess of $1 billion. (See First quarter 2019 deals with over $1B projected values, right, and Top Q1 2019 biopharmaceutical licensings by value, below.)

Taking into account deal values that include up-front payments, equity investments and future downstream milestones, the first quarter recorded seven transactions that had values in excess of $1 billion. (See First quarter 2019 deals with over $1B projected values, right, and Top Q1 2019 biopharmaceutical licensings by value, below.)

For example, a new U.S.-China drug discovery deal focused on developing bispecific therapies for cancer could see Woburn, Mass.-based Abpro Therapeutics Inc. earn as much as $4 billion, including $60 million in near-term R&D funding from its Chinese partner, NJCTTQ, a subsidiary of Nanjing Chia Tai Tianqing Pharmaceutical Group Co. Ltd. The company, which is leveraging its Diversimmune antibody discovery platform for T-cell engagement, is also eligible to receive potential milestones and royalties. Its 30-person team will collaborate globally with NJCTTQ to pursue preclinical and clinical development efforts and, ultimately, commercialization, it said. Outside of China and Thailand, Abpro will retain all commercial rights for any approved molecules, while NJCTTQ will retain rights in China. (See BioWorld, March 6, 2019.)

Voyager Therapeutics Inc. was the beneficiary of heightened interest in the gene therapy space. In the period, it attracted two significant deals. One new partner, Neurocrine Biosciences Inc., agreed to pay the company $165 million up front and it has earmarked $1.7 billion for future milestone payments for the rights to develop and commercialize four experimental adeno-associated virus-based gene therapies, beginning with one for Parkinson's disease (PD) and another for Friedreich's ataxia (FA). The agreement, which includes co-commercialization options for Voyager, will broaden Neurocrine's pipeline of movement disorder drugs. (See BioWorld, Jan. 20, 2019.)

Just one month later, Voyager signed a second deal with Abbvie Inc., also involving Parkinson's disease. North Chicago-based Abbvie paid $65 million up front in exchange for an exclusive option to license vectorized antibodies targeting misfolded alpha-synuclein proteins for synucleinopathies. (See BioWorld, Feb. 25, 2019.)

The agreement, which builds on a similar Alzheimer's disease deal between the two last year, will see Voyager receive up to $245 million in preclinical and phase I option payments as well as up to $1.23 billion in additional milestones, plus royalties.

Going forward, Voyager will carry out all the research and preclinical development work covered in the partnership to "vectorize" Abbvie-selected antibodies. After that, Abbvie can select one or more candidates to advance, first into investigational new drug-enabling studies and then into clinical development. Following phase I, Abbvie has an option to license the vectorized antibodies for further development and global commercialization.

Voyager could receive up to an additional $728 million in development and regulatory milestone payments for each compound covered by the agreement and is eligible to receive tiered royalties on the global commercial net sales of each antibody.

Cancer-focused therapies

There is no doubt that cancer-focused therapeutics and technologies related to their development remain the top target for biopharma companies. BioWorld and Cortellis data showed 28% of the first-quarter deals were focused in that area. In terms of value, cancer-related deals also garnered 52% of the total deal value at almost $23 billion. (See Number and Value of Biopharma 2019 Deals by Therapeutic Focus, below.)

In addition to the Abpro Therapeutics deal, two further potential $1 billion-plus deals were signed in the oncology space.

Genentech Inc., part of Roche Holding AG, signed a partnering deal with Seattle-based Adaptive Biotechnologies Corp. to develop a new type of cell therapy for solid cancers targeting individual's tumor-specific proteins, or neoantigens. Genentech paid Adaptive $300 million up front to leverage Adaptive's TruTCR screening platform. Downstream, potential development, regulatory and commercial milestones could add more than $2 billion to the pot. (See BioWorld, Jan. 7, 2019)

Cambridge, Mass.-based Codiak Biosciences Inc. received $56 million up front from Dublin-based Jazz Pharmaceuticals plc to develop exosome-based therapeutics for cancer. Jazz was granted an exclusive, worldwide, royalty-bearing license to develop, manufacture and commercialize therapeutic candidates directed at five targets to be developed using Codiak's engEx precision engineering platform for exosome therapeutics. The targets focus on oncogenes such as NRAS and STAT3 that, although well-validated in hematological malignancies and solid tumors, have been undruggable. (See BioWorld, Jan. 4, 2019.)

The value of the deal includes up to $200 million for each of the five targets, based on IND acceptance along with reaching other clinical and regulatory benchmarks, including approvals in the U.S., European Union and Japan, and the achievement of sales goals. Codiak also stands to gain tiered royalties on net sales of each approved product.

Codiak will carry out preclinical and early clinical development of therapeutic candidates directed at all targets through phase I/II proof-of-concept studies. Following that, Jazz will assume development and any regulatory submissions for each product, as well as commercialization.

Neurology deals increasing

In addition to cancer, neurology/psychiatric-related deals continue to garner interest from companies, with 15% of the total deals focused in that area and collectively involving almost $7 billion in deal value. Infection- and gastrointestinal-focused areas ranked third and fourth, respectively, in terms of deal volume.

A notable deal in the neurology space involved Watertown, Mass.-based C4 Therapeutics Inc., which is focused on targeted protein degradation technology spun out from the Dana-Farber Cancer Institute. It has partnered with Biogen Inc. to discover and develop treatments for neurological conditions, including Alzheimer's disease and Parkinson's disease. The deal could be worth $415 million in up-front and milestone payments. C4's discovery platform, dubbed Degronimids, involves small molecules with adapters that facilitate the tagging of proteins with ubiquitin, resulting in the rapid destruction and clearance of the target protein from the cell through the proteasome system.