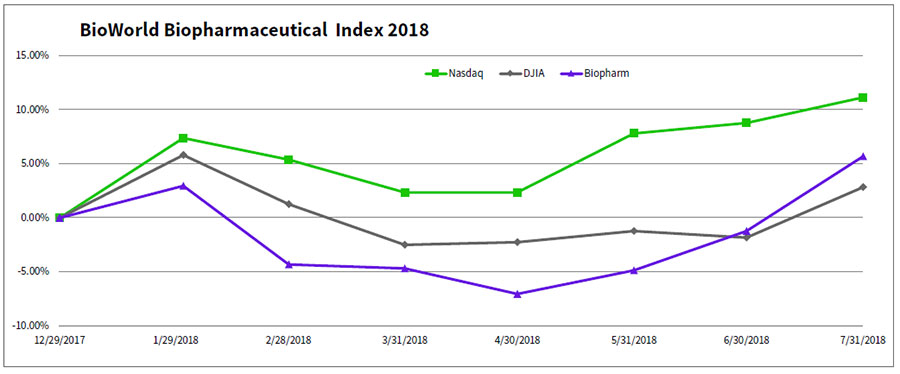

Blue chip biopharmaceutical companies emerged from their six-month swoon with a strong market performance. A series of beat and raise second-quarter earnings reports coupled with pipeline successes during July coaxed investors off the sidelines and, for the first time this year, the BioWorld Biopharmaceutical index closed in positive territory, thanks to an almost 7 percent jump in value, beating the Dow Jones Industrial Average, which recorded a 4.7 percent increase, and the Nasdaq Composite index, which rose 2 percent. The significant increase also brought up the year-to-date performance of the index to 6 percent compared to the Dow, which is up 3 percent, and the Nasdaq, which is tracking up 11 percent. (See BioWorld Biopharmaceutical index, below.)

Beating consensus

It was a win-win month for Biogen Inc. Not only did it post a strong second quarter, thanks to increasing demand for spinal muscular atrophy drug Spinraza (nusinersen), but also it started off the month with good news on the innovation front. Along with partner Eisai Co. Ltd., it reported top-line results from the final, 18-month analysis of the phase II study with anti-amyloid beta protofibril antibody BAN-2401 in early Alzheimer's disease (AD). The findings showed statistically significant slowing of progression based on the Alzheimer's Disease Composite Score, or ADCOMS, and reduction of amyloid accumulated in the brain measured using amyloid-positron emission tomography, or PET – both predefined efficacy endpoints. (See BioWorld, July 9, 2018.)

The news got investors engaged again even though a later deeper dive into the results saw analysts scratching their heads as to whether the specific trial validated or negated the amyloid hypothesis in AD.

Writing in their monthly Biotech Thermometer report, Cowen analysts noted, "Despite BAN-2401's data not fully living up to early-month expectations, interest in the large caps ticked higher in July – this was a consequence of solid financial reports, pipeline events that included more good than bad news."

For Cambridge, Mass.-based Biogen, its better-than-expected quarterly profit helped the company beat consensus earnings estimates and raise its 2018 financial guidance. It reported total revenues of $3.4 billion, a 9 percent increase vs. the second quarter of 2017. Sales of its multiple sclerosis drugs led the way, hitting $2.3 billion during the quarter, including about $113 million in royalties on the sales of Ocrevus (ocrelizumab), the multiple sclerosis drug on which Biogen collaborated with Roche Holding AG's Genentech unit. Revenue growth was driven in large part by Spinraza, which generated $423 million in sales as the company expanded the drug's global reach. The number of commercial patients on Spinraza has increased by about 28 percent from last quarter. The company's shares (NASDAQ:BIIB) posted a monthly gain of 15 percent, making it one of the leading gainers in the group.

The top biotech company by market cap, Amgen Inc., also posted a solid quarter, with Jefferies analyst writing on the company in a research note, "another solid beat and raise result . . . our 2018 estimates go up again and we're at the high end of guidance. We think the stock will go well north of $200-220 (15x) if they manage Neulasta biosimilar risk and take the fears off the table."

Amgen reported that sales of bone marrow stimulant Neulasta (pegfilgrastim) was up just 1 percent quarter over quarter, based on a higher sales price that was partially offset by lower unit demand. The drug is about to encounter biosimilar headwinds with last month's approval of Mylan NV's Fulphila (pegfilgrastim-jmbd), co-developed with Biocon Ltd., of Bangalore, India, as the first U.S. biosimilar to Neulasta. (See BioWorld, June 6, 2018.)

However, the company has plenty of products to supplement that potential revenue erosion going forward. Sales of cholesterol drug Repatha (evolocumab) recorded a spike of 78 percent in quarter-over-quarter sales, driven primarily by unit demand and partially offset by lower net selling price. Sales of Blincyto (blinatumomab), indicated to treat acute lymphoblastic leukemia, increased 40 percent. Sales grew by 25 percent for multiple myeloma drug Kyprolis (carfilzomib), and osteoporosis treatment Prolia (denosumab) showed sustained strength, increasing 21 percent quarter over quarter, as did those of bone metastases agent Xgeva (denosumab), whose sales grew 14 percent. Amgen shares (NASDAQ:AMGN) closed July up about 6.5 percent at $196.55.

Similar story

Several other large cap biotechs joined the beat and raise parade. Gilead Sciences Inc., for example, reported total product sales for the second quarter of $5.5 billion vs. $7 billion for the same period in 2017, reflecting both higher sales of HIV therapies containing emtricitabine and tenofovir alafenamide as well as lower sales of chronic hepatitis C therapies such as Harvoni (ledipasvir/sofosbuvir), Epclusa (sofosbuvir/velpatasvir) and Sovaldi (sofosbuvir) across all major markets as a result of increased competition. Net income was $1.8 billion, or $1.39 per share, vs. $3.1 billion, or $2.33 per diluted share, in 2017. The earnings report was also notable because the company raised eyebrows when it also announced that President and CEO John Milligan will step down at the end of the year, following just about two years in the top post at the Foster City, Calif.-based company and a 28-year career with the firm. Gilead shares (NASDAQ:GILD) closed July up about 10 percent at $77.83. The increase was enough to qualify the company for membership in the exclusive $100 billion market cap club once again.

It was a similar story for Summit, N.J.-based Celgene Corp., which posted a better-than-expected second-quarter profit. Its second-quarter revenue hit $3.8 billion, a 17 percent increase vs. the second quarter of 2017, led by sales of Revlimid (lenalidomide). (See BioWorld, July 27, 2018.)

On the innovation side of the coin, Celgene also started off the month well when a phase III study evaluating the ability of the red blood cell maturation agent luspatercept to help people with anemia caused by low- to intermediate-risk myelodysplastic syndromes, a form of blood cancer, minimize the need for blood transfusions met its primary endpoint. The company has been working with Acceleron Pharma Inc. on the compound since 2011. Shares of Celgene (NASDAQ:CELG) closed the month up 13 percent, reducing its year-to-date loss by half.

Boston-based Vertex Pharmaceuticals Inc. saw its shares (NASDAQ:VRTX) increase 3 percent in the period. The company reported second-quarter total cystic fibrosis (CF) product revenues of $750 million, a 46 percent increase vs. $514 million in the second quarter of 2017, on strong demand for its latest CF drug, Symdeko (tezacaftor/ivacaftor and ivacaftor).

Pricing back to top of agenda

During the period companies were buffeted by political headwinds on pricing. In particular, President Donald Trump had an extensive conversation with Ian Read, CEO of Pfizer Inc., to get the pharma to hold off on midyear list price increases. (See BioWorld, July 13, 2018.)

The widely reported exchange resulted in Pfizer issuing a statement explaining it was deferring the price increases it planned to take on some of its prescription drugs. That development, Cowen analysts observed, "have markedly diminished the industry's desire to use the pricing lever to augment growth. Amgen, Gilead, Celgene and a number of large pharma companies announced on their Q2 calls that they would not increase the prices of any drugs during the rest of the year."

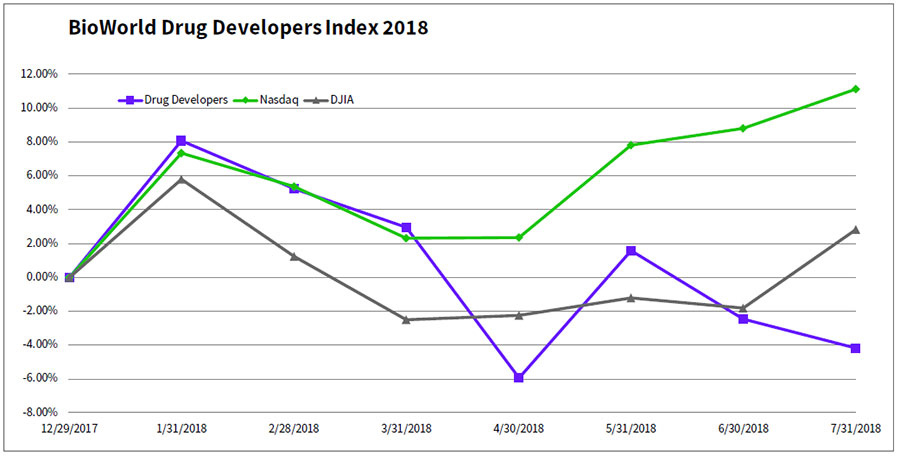

Drug developers

With most of the attention focused on large caps, emerging drug developers, as a group, did not generate much traction, with the BioWorld Drug Developers index falling about 2 percent in July. (See BioWorld Drug Developers Index, below.)

The only standout gainer among a sea of decliners was Pacira Pharmaceuticals Inc., whose shares jumped 25 percent. Investors were impressed with the Parsippany, N.J.-based company's growing market adoption of Exparel (bupivacaine liposome injectable suspension), which had net product sales of $80.4 million for the second quarter, representing a 15 percent increase over net product sales of $69.8 million reported in the second quarter of 2017.

Going forward

Heading into the dog days of summer it is expected market activity for the biopharmaceutical sector will be muted as business development plans are put on hold for holidays and earnings reporting. Post Labor Day, the political rhetoric in the U.S. will be amped up as the November midterm elections approach and that could see biotech investors return to the sidelines for the next few months. This will mean that the sector's collective market performance will remain flat for the rest of the year. It will, therefore, appreciate the fact that it managed to get its head above water in July.