Seven big pharma company executives from Abbvie Inc., Astrazeneca plc, Bristol-Myers Squibb Co., Johnson & Johnson, Merck & Co. Inc., Pfizer Inc. and Sanofi SA were called to face a grilling last week from members of the U.S. Senate Finance Committee at their second hearing on prescription drug prices. (See BioWorld, Feb. 27, 2019.)

Their testimonies were careful not to point fingers as they discussed the misalignment of the drug pricing chain, explaining that the system in which drug companies pay large rebates to pharmacy benefit managers (PBMs) for a preferred place on the formulary is hurting competition and creating perverse incentives for higher and higher prices. The event could have put the sector under market pressure, but at the end of the day the companies came through the process relatively unscathed, and investors appeared to be satisfied with what transpired at the hearing. As a result, the sector continued to maintain its excellent start to the year.

In its monthly biotech thermometer report to clients, the Cowen and Co. biotechnology analyst team noted the positive performance of the sector on the capital markets was helped in part by "the fact that big biopharma continued to make acquisitions at significant premiums."

The ongoing rally of biotech equities after their dismal fourth-quarter performance "proved resilient as investors were largely unfazed by the high-profile drug pricing hearings in Washington, and some underwhelming clinical catalysts," the Cowen report added.

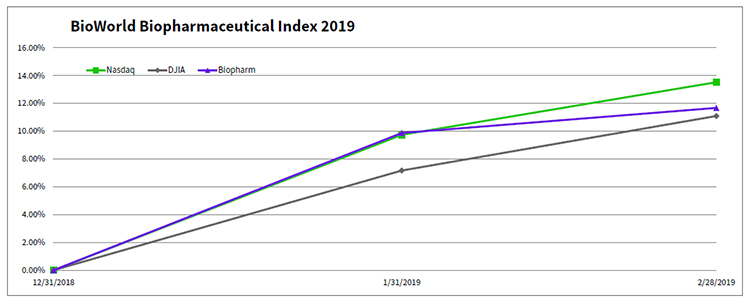

The BioWorld Biopharmaceutical index closed out February in positive territory, up 1.6 percent and has recorded an almost 12 percent increase in valuation since the start of the year. The broader markets followed a similar trajectory, with the Dow Jones Industrial average increasing 3.6 percent in the month and 11.1 percent year-to-date (YTD) and the Nasdaq Composite jumping 3.4 percent and 13.5 percent in the same periods. (See BioWorld Biopharmaceutical Index, below.)

Group performance

The performance of the six pharma companies that are members of the BioWorld Biopharmaceutical index (Johnson & Johnson is not a member) collectively returned a 4 percent increase in their share prices confirming that investors are not shying away from the drug pricing headwinds that the sector is facing.

Astrazeneca returned an almost 14 percent jump in its share value (NYSE:AZN) in February. Last week, the company, along with Merck & Co. Inc. reported positive results from the phase III POLO trial, exploring the efficacy of PARP inhibitor Lynparza (olaparib) tablets as first-line maintenance monotherapy in patients with germline BRCA-mutated metastatic adenocarcinoma of the pancreas whose disease has not progressed on platinum-based chemotherapy. There was a statistically significant and clinically meaningful improvement in progression-free survival with Lynparza vs. placebo.

Merck's shares (NYSE:MRK) closed February up 9 percent.

Among the big biotech companies in the group, Jazz Pharmaceuticals plc (NASDAQ:JAZZ) was the leading gainer, seeing its share valuation vault 11 percent. The uptick was helped by the company reporting solid top- and bottom-line beats for the fourth quarter and providing strong guidance for the rest of this year. The Dublin-based company reported its drug for narcolepsy symptoms, Xyrem (sodium oxybate), recorded an increase in net product sales of 18 percent in 2018 and 20 percent in the fourth quarter of 2018, compared to the same periods in 2017. Vyxeos (daunorubicin and cytarabine) net product sales were $100.8 million in 2018, compared to $33.8 million in 2017. The company launched Vyxeos for the treatment of adults with two types of high-risk acute myeloid leukemia in the U.S. in August 2017 and initiated a rolling launch in the EU in September 2018.

Drug developers on a tear

The resurgence of investor interest in biopharmaceutical companies has spilled over to the small and midcap drug developers.

According to a Cowen survey of investors, "they are most convinced that midcap biotech will outperform during 2019."

The BioWorld Drug Developers index is certainly off to a great start, soaring 13 percent in February and is now up 33 percent YTD, reflecting the positive environment that exists for those equities. (See BioWorld Drug Developers index, below.)

Leading gainer in the group was New York-based TG Therapeutics Inc.. whose shares (NASDAQ:TGTX) vaulted 66 percent on news that the marginal zone lymphoma cohort of its UNITY-NHL phase IIb pivotal trial evaluating umbralisib (TGR-1202), a once daily, PI3K delta inhibitor, met the primary endpoint of overall response rate (ORR) as determined by an independent review committee for all treated patients (n=69). The results met the company's target guidance of 40 percent to 50 percent ORR. Interim safety and efficacy data from that study will be presented at the American Association of Cancer Research annual meeting in April.

Acadia Pharmaceuticals Inc., of San Diego, saw its shares (NASDAQ:ACAD) jump 16 percent in the month. In its year-end financials, it reported net sales of Nuplazid (pimavanserin), an FDA-approved treatment for hallucinations and delusions associated with Parkinson's disease psychosis, were $59.6 million for the fourth quarter, an increase of 37 percent as compared to $43.6 million reported for the fourth quarter of 2017. For the year, net product sales were $223.8 million, compared to $124.9 million in 2017.

Uptick in M&As

Investors have also warmed to the biopharmaceutical sector since the beginning of the year, anticipating that there will be an increase in the number of M&A transactions going forward. They believe companies in the oncology space will be the targets for takeout. That belief was certainly reinforced with Roche Holding AG's announcement last week that it was acquiring Spark Therapeutics Inc., paying $114.50 per share in an all-cash deal valued at about $4.8 billion. Spark will operate as an independent firm inside Roche after the deal is complete. (See BioWorld, Feb 26, 2019.)

The rare disease space has also seen a resurgence of interest in the past five years and business development has been robust. It is likely we will see an increasing number of acquisitions of companies involved in rare diseases following Ipsen SA's $1.04 billion cash offer to acquire Montreal-based Clementia Pharmaceuticals Inc. The deal involves an additional $263 million for a contingent value right worth $6 per share tied to FDA acceptance of Clementia's NDA for its lead drug, palovarotene, an agonist of retinoic acid receptor gamma, in multiple osteochondromas.

The company is working on filing an NDA later this year for palovarotene, which inhibits excessive bone morphogenetic protein signaling, targeting fibrodysplasia ossificans progressiva, an ultra-rare autosomal dominant condition in which muscle and connective tissue are gradually replaced by bone. (See BioWorld, Feb 26, 2019.)