The increase in the incidence of multidrug-resistant (MDR) bacteria has galvanized governments to stimulate industry efforts to develop new therapeutics to replace its current arsenal of antibiotics. It appears that this research and development stimuli in terms of economic incentives and market exclusivity is now gathering momentum, with a host of new companies formed, thanks to venture investments, and lucrative partnerships being inked. In this two-part article, the business and financial climate for developers of antibiotics will be examined along with the product pipeline progress that is being made.

"The world urgently needs new classes of antibiotics and other life-saving products to prevent, diagnose and treat deadly infections," said Kevin Outterson, executive director of CARB-X and Boston University law professor.

The U.K.-U.S. public-private partnership Combating Antibiotic Resistant Bacteria Biopharmaceutical Accelerator (CARB-X), a nonprofit partnership headquartered at Boston University, has about $500 million at its disposal over the next five years to provide promising antibiotics researchers the financial support they need to help those projects succeed. The organization is being funded by the U.S. Department of Health and Human Services Biomedical Advanced Research and Development Authority (BARDA), the Wellcome Trust, the U.K. Department of Health and Social Care's Global Antimicrobial Resistance Innovation Fund, and the Bill & Melinda Gates Foundation, with in-kind support from the National Institute of Allergy and Infectious Diseases (NIAID), part of the U.S. NIH.

Among its first round of grants in 2017 was the development of 10 antibiotic programs that are all aimed at gram-negative bacteria. (See BioWorld, April 3, 2017.)

One of the grant recipients, San Diego-based Forge Therapeutics Inc., received $4.8 million, with a further $4 million reserved for potential milestones, to develop small-molecule inhibitors of LpxC, a zinc metalloproteinase found only in gram-negative bacteria and essential for the formation of their resistant outer membrane. That target has attracted a great deal of interest because it is conserved across gram-negative bacteria and not found in gram-positive bacteria or in humans.

Milestone reached

In August, Forge said it achieved its technical milestones and qualified to receive up to $4 million to continue developing an I.V./oral LpxC antibiotic to treat urinary tract infections, including MDR infections.

In January, the company received a second CARB-X award of up to $5.7 million and a further 5.4 million earmarked for the achievement of technical milestones, to support the development of LpxC inhibitors targeting serious lung infections caused by gram-negative bacteria, including multidrug resistant P. aeruginosa.

Recida Therapeutics Inc., of Menlo Park, Calif., has also entered the field to target LpxC. Frazier Healthcare Partners led its $8.5 million series A investment round to support lead program RC-01, an IND-stage LpxC inhibitor for the treatment of multidrug-resistant gram-negative infections licensed from Fujifilm Toyama Chemical Co. Ltd. for all territories outside Japan. Recida intends to a submit an IND to the FDA for the product in the first quarter.

It also was awarded up to $4.4 million from CARB-X to help fund the preparation of an IND application, a phase I trial to be completed in 2019 and drug product manufacturing to support subsequent phase II studies. In addition, the company has entered a partnership with Foster City, Calif.-based Micurx Pharmaceuticals Inc. for development and commercialization of RC-01 in the greater China region.

In preclinical testing, the company reported that RC-01 has shown ability to inhibit LpxC, a key enzyme in Lipid A biosynthesis and essential component of the protective outer membrane of gram-negative bacteria.

Another CARB-X grantee is Swiss biopharmaceutical company Polyphor AG, which this month was awarded initial funding of up to $2.6 million and $3 million for project milestones to support the development of an outer membrane protein targeting antibiotic (OMPTA) candidate targeting gram-negative ESKAPE pathogens, (Klebsiella pneumoniae, Acinetobacter baumannii, Pseudomonas aeruginosa and Enterobacter spp).

The company's lead product, murepavadin, (POL-7080) is in phase III development against P. aeruginosa. The first-in-class cyclic peptide targets lipopolysaccharide transport protein D, an outer membrane protein expressed by that bacterial species.

The study will enroll 120 patients, and Polyphor expects to obtain a readout by the end of 2020. A second phase III trial will recruit more than 200 patients in the U.S. (See BioWorld, April 30, 2018.)

Public domain

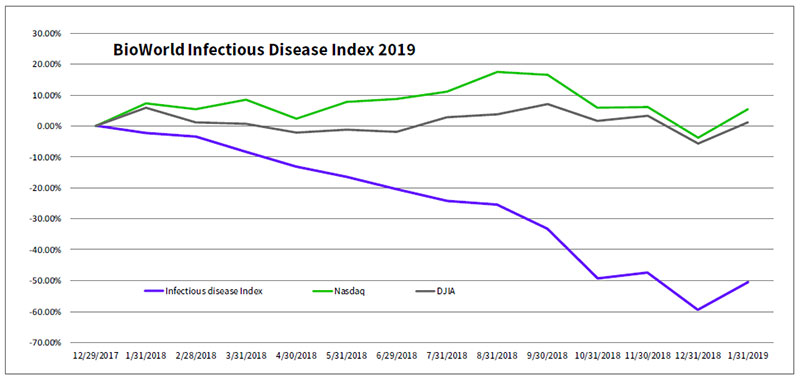

After an almost 60 percent swoon in the valuation of the BioWorld Infectious Disease index in 2018, investors appear to be taking a second look at companies developing medicines against infectious diseases. The increase in business activity and news flow of those companies helped the index jump 22 percent in January. (See BioWorld Infectious Disease index, below.)

Leading gainer in the month was Cambridge, Mass.-based Spero Therapeutics Inc., whose share value (NASDAQ:SPRO) vaulted 71 percent. The company recently announced that its IND for SPR-994, its lead product candidate designed to be the first oral carbapenem antibiotic, for the treatment of complicated urinary tract infections (cUTI) had been accepted by the FDA. The company can now proceed with its plans to initiate enrollment in a pivotal phase III trial in cUTI. The study will compare oral SPR-994 with an existing standard-of-care I.V. antibiotic, ertapenem, in approximately 1,200 patients. The primary endpoint of the trial will be the combined clinical and microbiological response at the test of cure with a 10 percent noninferiority margin vs. I.V. ertapenem.

Last month, Spero also reported that it is collaborating with Everest Medicines involving two additional molecules in pipeline. Everest will develop, manufacture and commercialize SPR-206 in greater China, South Korea and certain southeast Asian countries and also receives an exclusive option to rights to SPR-741 in the territory.

Both those I.V.-administered product candidates are being developed as options to treat MDR gram-negative bacterial infections.

SPR-206 entered a phase I trial in December, with top-line data expected in the second half of this year. SPR-741 is a compound designed to expand the spectrum and enhance the potency of existing antibiotics, and it completed a phase Ib drug-drug interaction trial in July, which demonstrated safety and pharmacokinetic compatibility when co-administered with beta-lactam antibiotics.

Spero will receive an up-front payment of $2 million and is eligible to receive milestone payments of up to an additional $59.5 million.

Acceleration

A two-month acceleration in Dublin-based Nabriva Therapeutics plc's PDUFA goal date for the completion of the FDA's review of the Contepo (fosfomycin for injection) new drug application helped the company's shares (NASDAQ:NBRV) jump more than 30 percent. The agency's decision is now expected April 30 due, the company said, to a clarification of the classification and subsequent expedited review period for the product indicated for the treatment of complicated urinary tract infections, including acute pyelonephritis.