Investors have warmed to the biopharmaceutical sector since the beginning of the year, and they are anticipating that there will be an increase in the number of M&A transactions going forward. They are looking particularly at companies in the oncology space following Eli Lilly and Co.'s $8 billion buyout of Loxo Oncology Inc. last month (See BioWorld, Jan. 8, 2019.)

Indianapolis-based Lilly is taking over Loxo, of Stamford, Conn., for $235 per share in cash to bring aboard targeted cancer assets that include Vitrakvi (larotrectinib), approved in December to treat adult and pediatric patients with solid tumors that have a neurotrophic receptor tyrosine kinase gene fusion without an acquired resistance mutation, along with other promising candidates in Loxo's pipeline.

The deal demonstrates that there is mounting interest in the targeted oncology field and that could bode well for those companies that have strong pipelines and proven technologies in that area.

Riding the wave

The industry also remained bullish on immuno-oncology last year and although the sector did not see much M&A action, advancements in the technology did catalyze a wave of biopharma licensing deals. That could be a prelude to acquisitions. Certainly investors are getting behind public oncology companies, which is driving up their valuations.

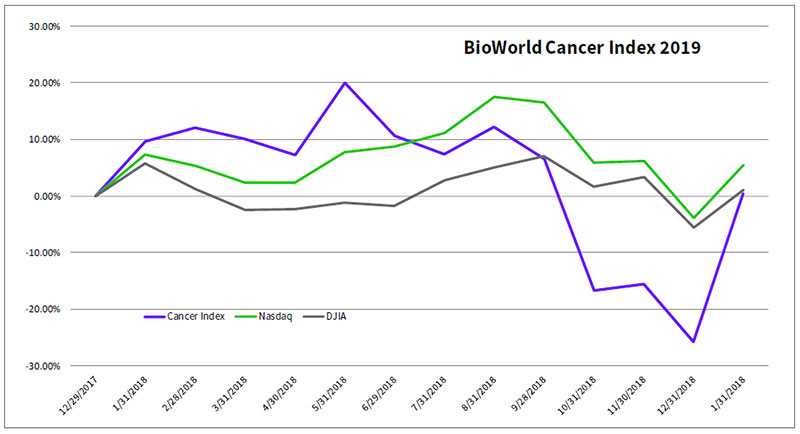

The BioWorld Cancer index, which closed the year down 26 percent, has come roaring back, soaring over 35 percent in January. (See BioWorld Cancer index, below.)

Immuno-oncology-focused Agenus Inc. was among the leading gainers in the group. The Lexington, Mass.-based company saw its shares (NASDAQ:AGEN) soar more than 41 percent. In January, it closed a major partnership deal with Gilead Sciences Inc. focused on the development and commercialization of up to five novel immuno-oncology therapies. (See BioWorld, Dec. 21, 2018.)

Agenus Inc. received $150 million on closing, which includes $120 million up front and a $30 million equity investment, and is in line for about $1.7 billion in downstream milestone payments. In return, Gilead gains worldwide rights to the bispecific antibody AGEN-1423, which has shown in preclinical studies it can enhance the antitumor activity of myeloid cells, NK cells, T cells and cancer-associated fibroblasts.

Array Biopharma Inc. also saw a nice 30 percent pop in its share value (NASDAQ:ARRY) in the month. It is basking in the regulatory success of the FDA's green light in June last year for the combo regimen of its oral, small-molecule BRAF kinase inhibitor and an oral, small-molecule MEK inhibitor for use in patients with unresectable or metastatic melanoma with BRAFV600E or BRAFV600K mutations.(See BioWorld, June 28, 2018.)

Approval of Braftovi (encorafenib) plus Mektovi (binimetinib) was based on initial data from a phase III COLUMBUS trial, demonstrating a nearly 15-month median progression-free survival.

Radar screen

With a current market cap of about $5 billion, the company could be on the radar screens of big pharma companies because it has a rich cancer product pipeline. Also, it has seen a strong start following the U.S. launch of Braftovi/Mektovi, which generated $22.7 million in sales during its fiscal-year second quarter, which represents quarter-over-quarter growth of 62 percent. Feedback from prescribers continues to be positive, the company said. The product has launched in Germany, Austria, the Netherlands and the U.K., with preparations for launch in other countries underway. Array posted total revenue of $82.5 million for the quarter. Net loss was $11.4 million, or 5 cents per share. As of Dec. 31, cash, equivalents and marketable securities were $478 million.

The next catalyst investors will be watching is interim top-line data from the phase III BEACON trial, evaluating Braftovi/Mektovi plus Erbitux (cetuximab) triplet regimen in BRAF-positive colorectal cancer (CRC). According to SVP Leerink analyst Thomas Smith, "We continue to see high probability of success (75 percent) for label expansion into this large, [$1-billion-plus] global opportunity with minimal competition."

In its financial report, Array noted that after meetings with the FDA and EMA it has initiated an amendment to the BEACON CRC protocol to allow for an interim analysis of trial endpoints. If the planned analysis based primarily on confirmed ORR and durability of response is supportive, the company plans to use the data to seek accelerated approval in the U.S.

Boulder, Colo.-based Clovis Oncology Inc. also performed well in January, with its shares (NASDAQ:CLVS) closing up 41 percent. The increase in value was helped by the news that the European Commission had approved the use of Rubraca (rucaparib), an oral, small-molecule inhibitor of PARP1, PARP2 and PARP3, for a second indication, as a monotherapy for the maintenance treatment of adults with platinum-sensitive, relapsed, high-grade epithelial ovarian, fallopian tube or primary peritoneal cancer who are in response (complete or partial) to platinum-based chemotherapy. That expands the drug's indication beyond its initial marketing authorization in Europe granted in May last year for ovarian cancer.

Bothell, Wash.-based Seattle Genetics Inc., which reported its year-end financials on Friday, is coming off a strong start to the year, with its shares (NASDAQ:SGEN) closing January up 35 percent.

The company reported that its total revenues for the year were $654.7 million compared to $482.3 million in 2017. The revenue growth was driven by a 55 percent increase in net sales in the U.S. and Canada of Adcetris (brentuximab vedotin), its anti-CD30 antibody-drug conjugate for two types of lymphoma.