Although developers of novel cancer therapeutics, particularly in the immuno-oncology area, have managed to attract the lion's share of investment funding and partnerships, that enthusiasm has not translated to the capital markets. The American Society of Hematology (ASH) annual meeting held earlier this month in San Diego, closely watched by analysts and investors alike, provided an opportunity for a number of public cancer-focused companies to present their latest clinical data. They were hoping that positive data would be rewarded with a much-needed bump in share valuations. Unfortunately, even though there were some promising presentations, at the end of the day, investors were not rushing to jump into those equities post-ASH.

Crowded space

One of the reasons for that situation, postulated by Leerink analysts, is the intense competition among biopharma companies working on the same promising target areas. For example, there were "no less than a dozen different multiple myeloma therapeutic programs targeting B-cell maturation antigen (BCMA), at least a year in advance of the first conceivable approval of any treatment addressing this target. This crowding seems to now be typical of promising new indications, targets and pathways," the report noted.

For example, at ASH, Newton, Mass.-based Karyopharm Therapeutics Inc. presented updated data from a phase IIb STORM study evaluating selinexor, a first-in-class, oral selective inhibitor of nuclear export (SINE) compound, in patients with penta-refractory multiple myeloma. For the study's primary objective, oral selinexor achieved a 26.2 percent overall response rate. The median progression-free survival was 3.7 months and the median duration of response was 4.4 months. Median overall survival across the study was 8.6 months. An NDA seeking accelerated approval for oral selinexor with low-dose dexamethasone as a treatment for patients with penta-refractory multiple myeloma is currently under FDA priority review with a PDUFA action date of April 6, 2019.

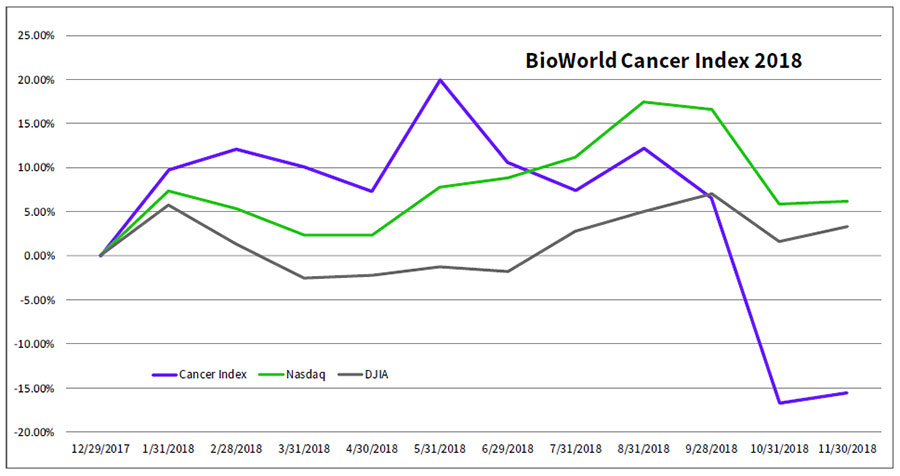

The strong data from that pivotal study did not help push the company's shares (NASDAQ:KPTI) any higher. In fact, by market close last Thursday they were trading down 6 percent – a performance that was mirrored by the majority of group members of the BioWorld Cancer index, which is down more than 6 percent this month compared with the approximately 3 percent dips in the Nasdaq Composite index and Dow Jones Industrial Average, respectively. Year to date, the index has languished, with its value sinking almost 16 percent. (See BioWorld Cancer Index, below.)

Decliners

Positive news relating to Beyondspring Inc.'s lead drug, plinabulin, a marine-derived small molecule, in late-stage clinical development for the prevention of chemo-induced neutropenia (CIN) and as a cancer therapy in non-small-cell lung cancer, was not enough to elevate the company's shares (NASDAQ:BYSI), which have dropped almost 17 percent this month and are now trading down 19 percent year to date (YTD).

The company reported the phase III portion of its pivotal study 105, evaluating plinabulin in 105 enrolled patients treated with docetaxel chemotherapy, met its primary endpoint of noninferiority vs. the current standard of care Neulasta (pegfilgrastim, Amgen Inc.) for the duration of severe neutropenia of the first cycle, with statistical significance in a pre-specified interim analysis.

Based on the results from that trial, as well as the top-line data from the phase II portion of study 106 released at ASH, the company said it has the necessary data to submit an NDA in China for the use of plinabulin for the treatment of CIN. The submission of an NDA to the FDA for the same indication is also in the works.

Although Agios Pharmaceuticals Inc. received FDA approval a month ahead of its Aug. 21 PDUFA date for Tibsovo (ivosidenib, formerly AG-120) to treat adults with relapsed or refractory acute myeloid leukemia with a susceptible isocitrate dehydrogenase-1 mutation, its share value (NASDAQ:AGIO) has pulled back considerably since that milestone, recording a 19 percent drop in value so far this month, a decline that has eroded its previous gains on the strength of its drug approval, and YTD they are up about 15 percent.

The oral drug became the first FDA-approved therapy in the targeted indication and the first in the class green-lighted with an FDA-approved companion diagnostic, the Abbott Realtime IDH1 test. (See BioWorld, July 23, 2018.)

A Cowen report on the company sees the pullback as an opportunity for investors. "We see AGIO as well equipped to navigate the transition from stealth stand-out in precision oncology drug development, continuing to emerge as a leading fully integrated next-generation biopharma," it said.

Bucking the trend

Boulder, Colo.-based Clovis Oncology Inc., which saw its shares (NASDAQ:CLVS) vault 48 percent in November, bucked the negative sentiment swirling around cancer biopharmas, with a further 25 percent increase this month to date. Its Rubraca (rucaparib) product, an oral, small-molecule inhibitor of PARP1, PARP2 and PARP3, gained accelerated approval as a monotherapy for the treatment of patients with deleterious BRCA mutation (germline and/or somatic)-associated advanced ovarian cancer, who have been treated with two or more chemotherapies. It was also granted FDA breakthrough therapy designation in October as a monotherapy treatment of adult patients with BRCA1/2-mutated metastatic castration-resistant prostate cancer who have received at least one prior androgen receptor-directed therapy and taxane-based chemotherapy.

Further good news followed last week when the company reported that the EMA's Committee for Medicinal Products for Human Use adopted a positive opinion recommending an additional indication to include rucaparib as a monotherapy for the maintenance treatment of adult patients with platinum-sensitive relapsed high-grade epithelial ovarian, fallopian tube or primary peritoneal cancer who are in response (complete or partial) to platinum-based chemotherapy. Full European approval could be received in the first quarter of next year.

Shares of Aduro Biotech Inc. (NASDAQ:ADRO) are also trending 10 percent higher this month, reversing the precipitous 66 percent drop since the beginning of October when the company announced that Johnson & Johnson's Janssen Biotech Inc. was terminating research and licensing agreements for the Berkeley, Calif.-based company's experimental lung and prostate cancer treatments. The termination left about $1.1 billion in potential milestone payments to Aduro unrealized, and returned three programs based on its live, attenuated double-deleted Listeria technology platform to the company. (See BioWorld, Oct. 3, 2018.)

More acquisitions possible

The fall in valuations of public cancer biopharmas could trigger a wave of M&As going forward. The time is certainly right given the current bearish markets, which are predicted to remain for the foreseeable future. Glaxosmithkline plc's acquisition of Tesaro Inc. to gain access to its potential blockbuster drug, Zejula (niraparib), approved and marketed in the U.S. and Europe as a second-line maintenance platinum ovarian cancer therapy, in a deal valued at approximately $5.1 billion, could be the first of several biopharma takeouts. (See BioWorld, Dec. 4, 2018.)

If companies are, in fact, planning to pull the trigger on deals then they have the perfect forum in the upcoming J.P. Morgan Healthcare conference to announce the details.