The Affordable Care Act hasn't been repealed and replaced for now. The biopharma sector was hoping that the introduction of a new bill would help resolve a number of thorny issues – including drug pricing – that have created headwinds for them for well over a year. For the time being, companies will have to assume it is business as usual until the subject of health care returns to the top of the administration's agenda once again.

With Congress turning its attention to economic growth and tax reform, that should be positive for the industry, particularly if President Donald Trump follows through with his intention of allowing a one-time special favorable tax on the repatriation of corporate cash held overseas. That initiative could be just the shot in the arm that the biopharma industry needs, with the additional cash – estimated to be in the region of $100 billion – being deployed to promote increased investments in the sector.

Investors are certainly thinking along the same lines because, despite all the uncertainties in the days leading up to the Republicans finally pulling their proposed health care bill from the House docket, blue chip biotech equities did not take much of a hit during that period. In fact, they were poised to close the month unchanged.

With one trading day left before the curtain closed on the first quarter of the year, the BioWorld Biopharmaceutical Index closed unchanged and, for the first quarter, is up a healthy 11.6 percent, outperforming the general markets, with the Dow Jones Industrial average seeing its value dip slightly (0.5 percent) in March but remaining up 4.6 percent for the quarter. The Nasdaq Composite returned a slightly better performance – up 1.5 percent for the month and 8.9 percent for the year. (See BioWorld Biopharmaceutical Index, below.)

Leading performer in the group by a wide margin was Vertex Pharmaceuticals Inc., which impressed investors with positive data from two phase III studies testing oral cystic fibrosis transmembrane conductance regulator (CFTR) corrector tezacaftor (VX-661) plus approved CFTR potentiator Kalydeco (ivacaftor) in cystic fibrosis (CF). (See BioWorld Today, March 30, 2017.)

Also in March, Vertex said it was acquiring CTP-656, a CFTR potentiator from Concert Pharmaceuticals Inc. for $160 million in cash for all worldwide development and commercialization rights. If CTP-656 is approved as part of a combination regimen to treat CF, the company could receive up to an additional $90 million in milestones based on regulatory approval in the U.S. and reimbursement in the U.K., Germany or France.

Vertex's shares (NASDAQ:VRTX) vaulted over 14 percent in the month and they are up 44 percent for the first quarter.

It wasn't a great month for Amgen Inc., whose shares (NASDAQ:AMGN) slipped almost 7 percent, but they are still up over 11 percent for the quarter. Gilead Sciences Inc. (NASDAQ:GILD) continued its slide, dropping 4 percent in March, and is now down 6.4 percent year to date. It has been a tough 12 months for the company seeing its share value erode by almost 30 percent in that period. For the company to halt that slide investors will want to see it make a major acquisition in the near future.

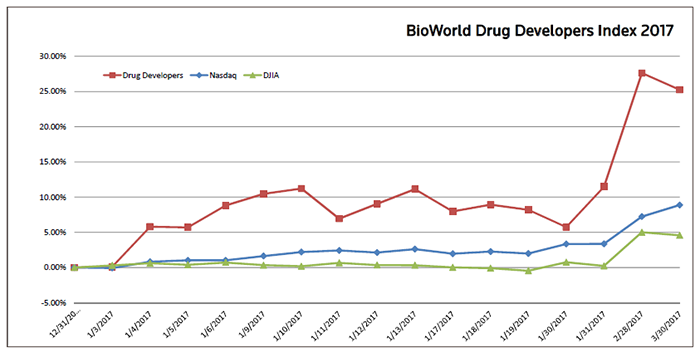

Drug developers also closed the month relatively unscathed, with the BioWorld Drug Developers index down just 1.85 percent, but the good news is that the group is still up a 25 percent in value for the quarter. (See BioWorld Drug Developers Index, below.)

Cash flows

Cash flowed freely into the coffers of global public and private biopharma companies in the first quarter this year to the tune of $6.8 billion, a 10 percent increase over the 6.2 billion amassed in the first quarter of 2016.

Public offerings, including IPOs, brought in about half of the total, and the total of those transactions were up 48 percent over the amount raised at this time last year.

Kite Pharma Inc. took top honors for the amount raised in the period, with the closing of an underwritten public offering of 4.75 million shares at $75 each, together with 712,500 additional shares being sold from the exercise in full of the underwriters' option. The gross proceeds were $409.7 million.

Honorable mentions go to Aurinia Pharmaceuticals Inc. and Heron Therapeutics Inc. Aurinia closed an underwritten public offering of 25.64 million common shares, including 3.34 million common shares from the full exercise of the underwriters' option, at $6.75 per share. The gross offering proceeds amounted to approximately $173.1 million.

The company is planning to start a single, phase III trial (AURORA) whose design, the company said, is consistent with the ongoing AURA-LV trial. Data from both trials will serve as the basis for a new drug application submission following completion of the phase III trial.

Aurinia reported the promising 48-week results from the AURA study of voclosporin, demonstrating significantly improved long-term outcomes for patients suffering from lupus nephritis. At the end of the period, the trial met the complete and partial remission (CR/PR) endpoints, demonstrating statistically significant greater CR and PR in patients in both low dose (23.7 mg of voclosporin twice daily (p<.001)) and high dose (39.5 mg twice daily (p=.026)) cohorts vs. the control group. Each arm of the study included the current standard of care of mycophenolate mofetil as background therapy and a forced steroid taper to 5 mg/day by week eight and 2.5 mg by week 16.

San Diego-based Heron generated total net proceeds from its public offering of approximately $163.7 million.

In its full-year financial results, the company reported that HTX-011, its investigational, long-acting formulation of the local anesthetic bupivacaine in a fixed-dose combination with the anti-inflammatory meloxicam for the prevention of postoperative pain, had produced statistically significant reductions in both pain intensity and the need for opioids compared to saline placebo following procedures with incisions ranging from very large (abdominoplasty) to very small (hernia repair and bunionectomy surgeries). Statistically significant reductions in pain and opioid use were also demonstrated when compared against bupivacaine solution, the current standard of care. Heron anticipates initiating phase III studies this year.

The company also launched its first commercial product, Sustol (granisetron), an extended-release injection indicated in combination with other antiemetics in adults for the prevention of acute and delayed nausea and vomiting associated with initial and repeat courses of moderately emetogenic chemotherapy or anthracycline and cyclophosphamide combination chemotherapy regimens.