In a statement from FDA Commissioner Scott Gottlieb on advancing the development of novel treatments for neurological conditions, he noted the brain is the last organ system where many aspects of our understanding of the underlying biology of disease remain uncertain.

It is a view that it shared by the research community. Roberta Diaz Brinton, director of the University of Arizona Center for Innovation in Brain Science at the University of Arizona Health Sciences, speaking at the 2017 annual meeting of the Society for Neuroscience, provided what might have been a harsh but probably accurate assessment of the state of translational research in the area: "In the 21st century, there is not a single cure for a single neurodegenerative disease. Not one. . . . There are no therapeutics. There is no strategy. There is bupkes in the 21st century." (See BioWorld, Nov. 14, 2017.)

Certainly, as Gottlieb comments, progress on the development of new therapies for complex neurological diseases has been challenging and the agency recognizes there is an urgent need for new medical treatments for many serious conditions, including neurological disorders such as muscular dystrophies, amyotrophic lateral sclerosis (ALS), Alzheimer's disease (AD), migraine and Parkinson's disease.

Undaunted by failures

The challenges faced by drug developers are clearly illustrated in Alzheimer's disease, which has been highlighted by a lengthy list of late-stage trial failures over the past few years.

Although clinical research, particularly in AD targeting amyloid beta and tau, has so far failed to translate from promising preclinical data into human efficacy, the market potential – as well as the need – for new therapeutics is enormous. According to data reported in the Alzheimer's Association 2018 Alzheimer's Disease Facts and Figures report released last week, an estimated 5.7 million Americans of all ages are living with Alzheimer's dementia in 2018. The association projects that by 2025 the number of people age 65 and older with Alzheimer's dementia will reach an estimated 7.1 million, a disconcerting increase of almost 29 percent from the 5.5 million who are 65 and older and affected currently.

Statistics on the economic burden to the country are just as staggering. For the second consecutive year, total payments to care for individuals living with Alzheimer's or other dementias are projected to surpass a quarter of a trillion dollars ($277 billion), which includes an increase of nearly $20 billion over last year. By 2050, the total cost of care for Alzheimer's is projected to increase to more than $1.1 trillion. These data from an accompanying special report from the Alzheimer's Association highlights new economic modeling data "indicating early diagnosis of the disease during the mild cognitive impairment (MCI) stage could save the nation as much as $7.9 trillion in health and long-term care expenditures."

"Soaring prevalence, rising mortality rates and lack of an effective treatment all lead to enormous costs to society. Alzheimer's is a burden that's only going to get worse," said Keith Fargo, director of scientific programs and outreach for the Alzheimer's Association.

BMI Research (a unit of Fitch Group), in an outlook for Alzheimer's disease drug development, noted that although "the list of failures continues to lengthen, the current pipeline is dynamic and companies will continue to invest, whilst looking to share/mitigate the risk and cost of development."

According to Cortellis Clinical Trials Intelligence, there are around 15 small-molecule and biologic drug candidates targeting AD being assessed in late-stage trials.

The significant R&D investments being made in AD is in keeping with the renewed interest in the neurodegenerative disease area in general. That has catalyzed into a number of high-profile deals being forged over the past three years, with the result that the total number of collaborations and licensing agreements has more than doubled, according data compiled by BioWorld and Clarivate Analytics' Cortellis Deals Intelligence. (See Bioworld Insight, July 3, 2017, and Feb. 20, 2018.)

Tracking clinical development

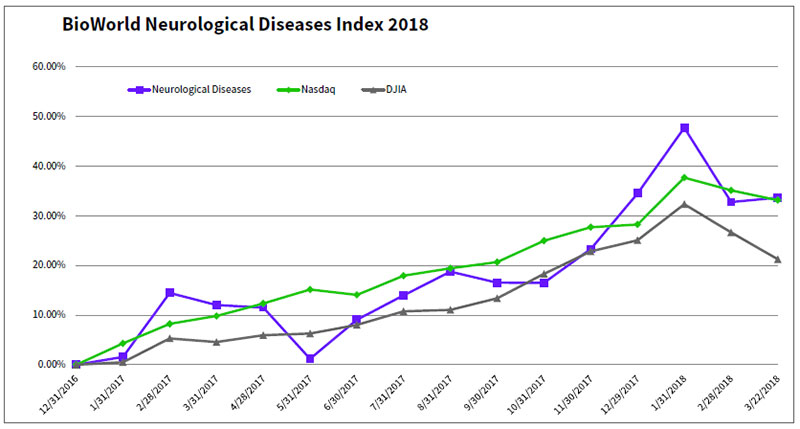

In order to track the progress of companies focused on the clinical development of treatments for neurological disorders, we are introducing the BioWorld Neurological Diseases index, which will track going forward the progress of 21 companies developing therapies in that area. (See BioWorld Neurological Diseases index, below.)

There is no doubt that investors are still keeping the faith in companies working in the area, despite all the challenges and recent clinical failures of promising therapeutics. According to the BioPharma Financings Report on the neurological/psychiatric therapeutic area, one of 15 separate analyses compiled by BioWorld and Clarivate Analytics focused on key therapeutic markets, cash raised by companies in that area in 2017 was the second highest behind cancer-focused companies.

The public markets also have been favorable, with the BioWorld Neurological Diseases index vaulting almost 34 percent since the beginning of last year. So far this year, the companies in the group, like most in the biopharmaceutical sector, have been dragged down by the woes of the general markets, and year-to-date the index is recording a slight drop in value of 0.6 percent.

Partnerships move the needle

Business development has certainly helped keep investors engaged in the area. Last month, for example, Voyager Therapeutics Inc. entered a partnership for its gene therapy platform, attracting Abbvie Inc. to help develop and commercialize vectorized antibodies against tau in AD and other neurodegenerative diseases. (See BioWorld, Feb. 21, 2018.)

Abbvie, of North Chicago, committed $69 million up front and $155 million in preclinical and phase I option payments. Voyager, of Cambridge, Mass., is eligible to receive $895 million in development and regulatory milestones if three vectorized tau antibodies emerge from the alliance, along with tiered royalties on global net sales of commercial products. The company's shares (NASDAQ:VYGR) are up 23 percent so far this year.

Also last month, Cambridge, Mass.-based Wave Life Sciences Ltd. impressed investors with the news it had signed a major deal with Takeda Pharmaceutical Co. Ltd. (See BioWorld, Feb. 22, 2018.)

Under the terms of the transaction, the company received a $110 million up-front payment and a $60 million equity investment to discover, develop and commercialize nucleic acid therapies for CNS disorders. Takeda also will fund at least $60 million of Wave research over a four-year period to advance multiple preclinical targets it selects and licenses. Specifically, the global pact gives Takeda the option to co-develop and co-commercialize programs in HD, ALS, frontotemporal dementia and spinocerebellar ataxia type 3, along with the right to license multiple preclinical programs targeting CNS disorders that include Alzheimer's disease and Parkinson's disease.

Altogether, Wave could bank more than $2 billion in such rewards plus tiered, high single-digit to midteen royalty payments on global sales related to each licensed program. The company's shares (NASDAQ:WVE) are up 15 percent so far this year.

Welcoming IPO market

Neurological disease-focused companies also have had no difficulty graduating to the public ranks during the past 15 months – group members Avenue Therapeutics Inc., Biohaven Pharmaceutical Holding Co. Ltd. and Ovid Therapeutics Inc. all completed their IPOs last year.

Although not yet part of the index, Denali Therapeutics Inc., of South San Francisco, generated a whopping $287 million from its IPO at the end of December.

Shortly after its debut on the public stage, the company announced a collaboration with Takeda to develop and commercialize an antibody treatment for Parkinson's disease and two antibody treatments for Alzheimer's disease. (See BioWorld, Jan. 8, 2018.)

Last week, Alzheon Inc., of Framingham, Mass., filed with the SEC to raise up to $80.5 million in an IPO. If the planned offering is successful, the company will use the funds to advance the clinical development of its lead candidate, ALZ-80, a phase III-ready, first-in-class, small-molecule oral inhibitor of amyloid aggregation and neurotoxicity in Alzheimer's disease.