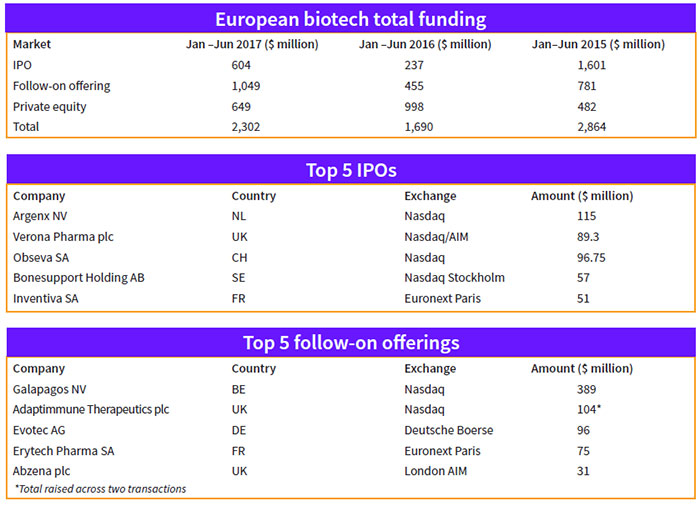

DUBLIN – European biotechnology firms engaged in drug discovery and development raised a total of $2.302 billion during the first half of the year, putting the sector on course for a creditable performance for 2017 as a whole. The running total for the first half of the year is 36 percent up on the equivalent figure of $1.69 billion for 2016 but behind that of 2015. (See total funding chart, below.)

A dramatic improvement in the public markets is the big difference between the two periods. European firms raised $640 million in IPOs during the first six months of 2017 vs. $237 million during the same period in 2016. The sector raised a further $1.049 billion in secondary offerings during the first half of 2017, well over double the amount raised – $455 million – during the same period in 2016.

Private equity is the only investment category to experience a downturn this year. The half-year tally is $649 million, as compared with $998 million for the equivalent period last year.

The tentative, but incomplete, recovery in IPO funding was geographically distributed. (See Top 5 IPOs, below.)

Nasdaq hosted two deals, those of women's reproductive health firm Obseva SA ($96.75 million) and antibody developer Argenx NV ($115 million), while respiratory disease specialist Verona Pharma plc's $89.3 million raise was split between Nasdaq and London's AIM.

The Nordic region saw a certain amount of action, too. Oncology firm Oncopeptides AB ($73 million) and orthobiologics firm Bonesupport Holding AB ($57 million) had solid IPOs on Nasdaq Stockholm, while oncology firm Isofol Medical AB raised $48 million on the junior Nasdaq First North exchange. Norway also got in on the act. Bergen Bio A/S, another cancer player, raised $46 million on the Oslo Børs. Several other small offerings were also completed on the Nasdaq First North exchange. Further south, gene therapy developer Lysogene SA and Inventiva SA, the former French R&D unit of Solvay SA, raised $24 million and $51 million, respectively, on the Euronext Paris exchange in February. Neither the U.K. nor Germany had any biotech IPOs.

The most significant new arrival to the ranks of quoted European biotech firms didn't actually raise any money. Idorsia Ltd., the part of Actelion Ltd. that Johnson & Johnson, of New Brunswick, N.J., didn't acquire, didn't need to. The Allschwil, Switzerland-based firm started out with CHF1 billion (US$1 billion) on its balance sheet, including CHF420 million in cash and CHF580 million in the form of a convertible loan from J&J subsidiary Cilag Holding AG, of Zug, Switzerland. It has access to another CHF250 million through a credit facility with Cilag. The company listed its shares (IDIA) on the Swiss Stock Exchange on June 16. Having opened at CHF10 – implying a market cap of CHF1.073 billion – the stock has quickly doubled as investors flock to founder Jean-Paul Clozel's vision of creating Actelion 2.0.

The standout transaction so far this year was Galapagos NV's mammoth follow-on public offering on Nasdaq, which raked in $398 million in April. It represented almost 38 percent of the total raised in all secondary offerings. No other firm breached the $100 million barrier, with the exception of immuno-oncology firm Adaptimmune Therapeutics plc, which took in $104 million across two transactions. The only other firm to come close was Evotec AG, with a $96 million equity investment from Novo A/S. (See follow-on chart, below.)

Other secondary offerings were generally smaller in scale. In total, 36 deals were completed, implying an average deal size of $29 million. In 2016, average deal size was similar – at almost $27 million – but the level of activity was much lower. Just 17 secondary share sales were completed during the first half of the year.

U.K. leads private equity deals

On the private equity side, the picture was the complete opposite. The number of transactions was similar – 46 in the first half of 2017 and 49 in the first half of 2016 – but average deal size was down from about $23 million to about $14 million. The top 10 deals in the first half of 2017 yielded a combined $412 million – the smallest of the top 10 deals was the $25 million raised by Oncoinvent AS, while the highest was Cell Medica Ltd.'s $74 million series C round. (See table, below.)

For the same period in 2016, the equivalent figure was $511 million, with Mission Therapeutics Ltd.'s $86 million C round topping the rankings and Novimmune SA's $31 million rounding them off. (Orchard Therapeutics Ltd. raised the same amount but only one of those transactions was included in the calculation.)

The U.K. continued its leadership in private equity, accounting for half of the 10 largest deals. "The U.K. is heavily capitalized with funds which are dedicated to U.K. opportunities only," Jonathan Tobin of London-based investment fund Arix Bioscience plc told BioWorld. "That just means there is more cash for companies that are raising money."

In general, European valuations are "somewhat realistic," he said. "I think the high-quality deals are oversubscribed in the main, particularly where there is a strong cornerstone investor," he added. But deals in locations such as Scandinavia, Central Europe and Germany are "less picked over" and offer good opportunities.

European biotechnology firms engaged in drug discovery and development raised a combined $3.789 billion over the entire year in 2016. In 2015, the total came to $4.930 billion. On its present trajectory, the total for the present year is likely to be somewhere in between those numbers. If the current year does not represent the absolute best of times for the sector, it is far from being the worst.