Venture capital investors gave it the old college try, but apparently they spent more time watching bowl games than investing in U.S. private biopharmaceutical companies in the fourth quarter.

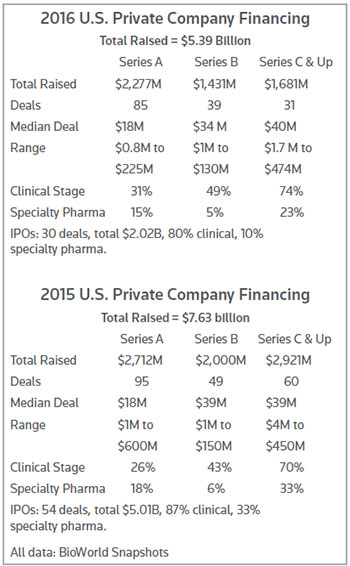

Trailing after the third quarter of 2016, it was probably asking too much to match 2015’s banner $7.63 billion investments. And the $5.39 billion worth of investments tracked by BioWorld Snapshots is still a respectable showing; in 2014, VCs only injected $3.85 billion into private companies.

We’ll call it a moral victory with the underdog covering the spread.

Digging into the details, more than half of the year-over-year shortfall came from series C or later investments, but that’s to be expected given the number of companies that have gone public over the last few years and the lack of company formation in the leaner times in the years prior.

The median deal size for late-stage investments was fairly similar between both years; it’s just the number of investments was cut in half.

At the other end of the spectrum, the number of new companies receiving series A financing, which includes seed rounds, dropped only slightly from 95 investments in 2015 to 85 investments in 2016. And the fourth quarter of 2015 had a whopping 37 series A investments – a quarterly high for the year – so some of those could have been accelerated from the first quarter of this year.

In terms of dollars, series A investments were down year over year ($2.28 billion vs. $2.71 billion the year prior), but 2015 had a massive $600 million investment in Cambridge, Mass.-based Boston Pharmaceuticals Inc. In 2016, the largest series A investment was just a $225 million in Bluerock Therapeutics. Sometimes it’s the big plays that win the games. (See BioWorld Today, Nov. 20, 2015, and Dec. 13, 2016.)

Series B investments also saw a year-over-year decline both in number of deals (39 vs. 49) and dollars ($1.43 billion vs. $2 billion), but one has to think that’ll reverse course in the coming years with so many series A investments over the last two years. We’re in a rebuilding year, for sure, but at least it’s a bumper recruiting class.

On the IPO front, the number of companies going public on U.S. exchanges fell to 30 in 2016 compared to 54 companies in 2015, but a decline in the number of companies turning pro was widely expected after the IPO draft floodgates opened in 2014.

Importantly, companies are still able to get funding through the public markets even if they don’t have any drugs in the clinic; 20 percent of companies that IPOed in 2016 were preclinical compared to 13 percent in 2015. The higher percentage in 2016 appears to have more to do with the large number of upper-classman companies itching to IPO in 2015 than a shift in investors’ sentiment to unproven freshman technologies; in absolute terms, there were six preclinical IPOs in 2016 vs. seven in 2015. (See chart, below.)

It’s a long, never-ending biotech season, and we’ve got another big game next week in the J.P. Morgan conference. Here’s hoping plenty of deals get done – perhaps over a beer while watching the National Championship game on the first night of the conference.