Articles Tagged with ''multiple myeloma''

2022 International Myeloma Workshop

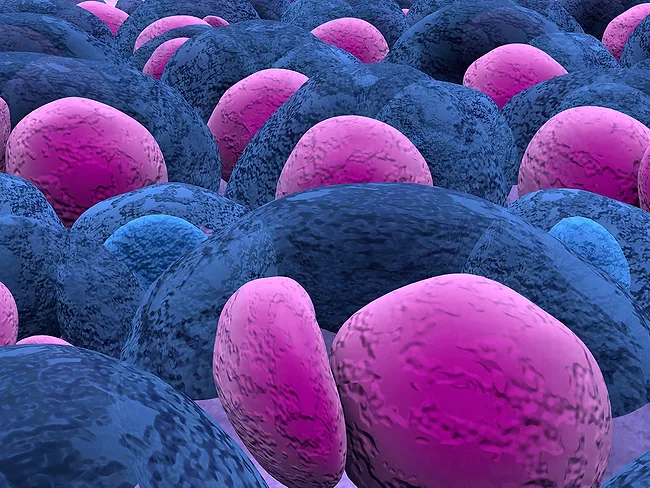

New biomarkers of treatment resistance identified in multiple myeloma

Read More2022 International Myeloma Workshop

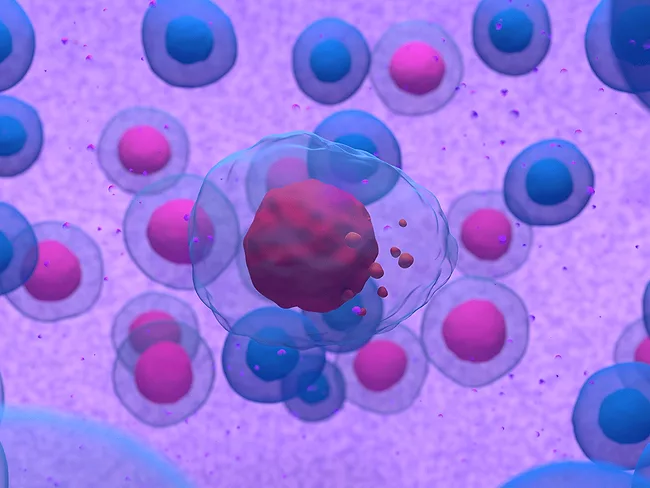

Circulating miR-27b-3p may aid in the diagnosis and prognosis of multiple myeloma

Read More2022 International Myeloma Workshop

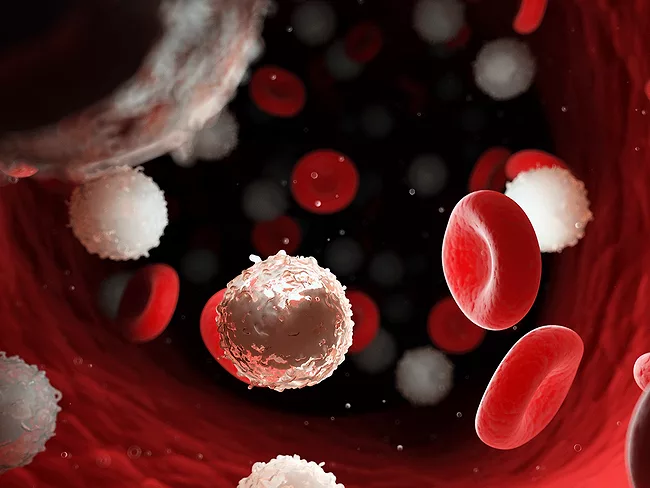

Onk Therapeutics presents data on CD38-targeting ONKT-102 CAR-NK cells for MM

Read More2022 International Myeloma Workshop