Now that the votes are in, the midterm election gives the U.S. a House/Senate outcome that will likely maintain the political status quo. It is predicted that for the next two years at least, with the Democrats controlling the House of Representatives and the Republicans in control of the Senate, implementation of new policies will be a challenge in Washington. (See BioWorld, Nov. 8, 2018.)

RBC Capital Markets analyst Brian Abrahams summed up the results of the midterm elections and its likely ramifications for the sector very well noting that, "we see upside potential to the sector on lessened political concerns and removal of an overhang that may have been holding some investors back temporarily into year-end. Though we didn't see [Tuesday] night's outcome as removing all political risk to the group, it should make it more difficult to enact any major changes to the drug-pricing regime in America (which was already unlikely) and help improve investor sentiment, especially for the larger-caps."

Blue-chip

For the first full trading day following the election results, Abrahams' analysis played out very nicely, with investors moving back to invest in biopharmaceutical companies across the board.

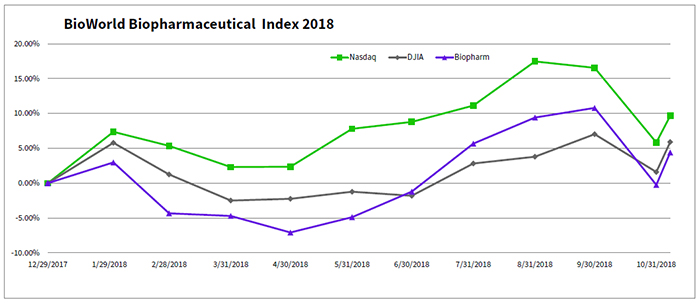

Blue chip companies, for example, saw their share prices increase, which helped drive up the BioWorld Biopharmaceutical index almost 5 percent – outpacing the Dow Jones Industrial index and Nasdaq Composite index, which returned 4 percent and 3.6 percent gains, respectively, in the same period. (See BioWorld Biopharmaceutical index, below.)

All members of the group were beneficiaries of the change in investor sentiment, with Alexion Pharmaceuticals Inc. (NASDAQ:ALXN) as the leading gainer, its share value up 13.5 percent. Gilead Sciences Inc. also saw its shares (NASDAQ:GILD) move up 6 percent, helped by news at the beginning of the month that it had signed a deal with Tango Therapeutics Inc. in the hot immuno-oncology (I-O) space. (See BioWorld, Nov. 1, 2018.)

Under the terms of the deal, Cambridge, Mass.-based Tango will handle target discovery and validation with its discovery platform based on functional genomics, and, Gilead, of Foster City, Calif., gains options to worldwide rights on up to five targets. Tango collects an up-front payment of $50 million and stands to gain about $1.7 billion more in rewards across all programs in the form of preclinical fees as well payouts if development, regulatory and commercial goals are reached.

Other notable gains were posted by Biogen Inc. (up 9 percent) and Regeneron Pharmaceuticals Inc. (up 7 percent).

Good news for drug developers

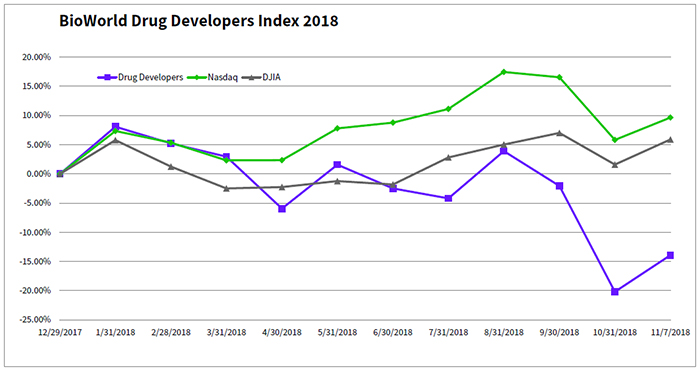

The election results also provided an uptick in the share values of small and midsized drug developers. The BioWorld Drug Developers index had been on an over 20 percent swoon since August, but on post-election trading day it saw an almost 8 percent jump in value. (See BioWorld Drug Developers index, below.)

Leading beneficiaries of the renewed investor enthusiasm were Clovis Oncology Inc., Horizon Pharma Inc. and Exelixis Inc.

At the beginning of the month, the shares of Boulder, Colo.-based Clovis (NASDAQ:CLVS) had taken a significant 30 percent hit following the release of a disappointing third-quarter financial report with revenue of $22.8 million from sales of its ovarian cancer treatment, Rubraca (rucaparib), falling well below consensus of $31.3 million. Net loss for the quarter was $89.9 million, or $1.71 per share. Clovis ended the quarter with $604.4 million in cash, cash equivalents and available-for-sale securities.

The company, however, recovered from the dramatic decrease in its share value with a significant 38 percent gain.

The shares of Dublin-based Horizon (NASDAQ:HZNP) gained almost 24 percent. Investors were impressed with the company's third-quarter results, in which it reported net sales growth of 64 percent for its gout drug Krystexxa (pegloticase). That helped bring third-quarter 2018 net sales to $325.3 million, an increase of 20 percent, driven, the company said, by continued strong growth of its orphan and rheumatology medicines. On a GAAP basis in the third quarter of 2018, net income was $26 million.

Alameda, Calif.-based Exelixis also saw its shares (NASDAQ:EXEL) climb 25 percent. It posted total third-quarter revenues of $225.4 million, compared to $152.5 million for the comparable period in 2017. Net product revenues of $162.9 million represented a 69 percent increase, reflecting the continued U.S. growth of Cabometyx (cabozantinib) for the treatment of advanced renal cell carcinoma. Net income for the quarter was $126.6 million, or 42 cents per share, basic, and 41 cents per share, diluted, compared to $81.4 million, or 28 cents per share, basic, and 26 cents per share, diluted, for the comparable period in 2017. The company ended the period with a cash balance of $750.3 million.

Going forward

While the sector did lose some momentum Thursday, with the BioWorld Biopharmaceutical index slipping a modest 0.4 percent and the BioWorld Drug Developers index falling 2.3 percent, it appears that it has found new life with investors becoming engaged once again. Absent of any new political headwinds biopharmas should close the year on a positive note.