DUBLIN – It’s all over and it’s all about to begin. After a stop-start series of negotiations, Johnson & Johnson and Actelion Ltd. have finally agreed to terms on a $30 billion takeover deal, under which J&J will pay $280 cash per Actelion share to acquire its slate of commercial products and two late-stage clinical development assets, while Actelion’s shareholders will retain ownership of the company’s drug discovery and early clinical development operations in a spin-off firm provisionally dubbed R&DNewco.

Immediately before the takeover deal is finalized in the second quarter, the new firm will be spun out with CHF1 billion (US$998,992 million) cash, and its shares will be listed on the Swiss Stock Exchange (SIX) in Zurich. Actelion CEO and co-founder Jean-Paul Clozel and its chairman, Jean Pierre Garnier, will play the same roles in the new company. Both companies will contribute to the newco’s initial funding, although they have not disclosed the split.

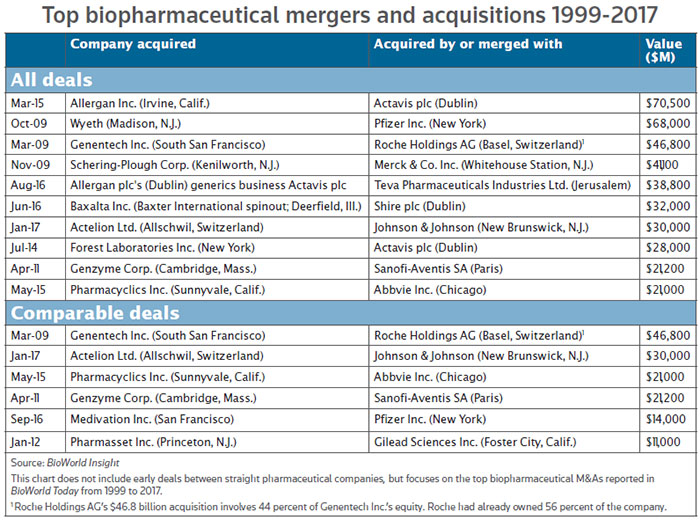

Shares in Allschwil, Switzerland-based Actelion rose by about 22 percent to CHF277 during early trading on Thursday before closing at CHF271.60. The deal is a massive vindication of Actelion’s Clozel and his management team, who have pulled off one of the largest M&A deals in the history of the biotechnology industry, while retaining a portfolio of assets that gives them another set of shots on goal. (See chart, below.)

“Brilliantly played hand by Jean-Paul Clozel, who gets to have his cake and eat it with the new R&D company, which is really what he loves doing,” one Switzerland-based industry observer told BioWorld Today.

It is also an emphatic vindication of the shareholders who backed Clozel and his team in the face of an effort by hedge fund managers Elliott Advisors to unseat them in 2011. “You can see how much value would have been stolen from investors if we had followed what we were asked to do at that time,” Clozel said during a press conference Thursday. Back then, the company’s shares were changing hands at less than CHF40. (See BioWorld Today, Feb. 9, 2011.)

The deal is structured in a way that allows J&J, of New Brunswick, N.J., to get what it wants while keeping some of the potential upside attached to Actelion’s more speculative assets. It is acquiring a product portfolio largely based around Actelion’s pulmonary arterial hypertension (PAH) franchise, as well as two rare disease products and two late-stage clinical assets.

Actelion generated almost CHF1.8 billion in product sales during the first nine months of 2016 and posted 17 percent growth. As well as driving further growth from the PAH business, J&J also has two near-term drug approvals in its sights. Ponesimod, a selective sphingosine-1-phosphate receptor 1 (S1P1R) modulator, is in phase III trials in multiple sclerosis, and cadazolid, an oxazolidine antibiotic, is in phase III for treating diarrhea associated with Clostridium difficile infection.

J&J will also hold a 16 percent equity stake in the newco and will have an option to take 16 percent more through a convertible note. It also has an option to in-license one of R&DNewco’s assets, ACT-132577, a pharmacologically active metabolite of Actelion’s marketed drug, Opsumit (macitentan), an endothelin receptor antagonist (ERA) approved for PAH. ACT-132577 has a different pharmacokinetic profile from its parent molecule – it has less potent receptor blocking effects but a longer half-life – and is currently undergoing a phase II trial in patients with resistant hypertension.

For Actelion’s leadership, the deal structure preserves what Clozel described as “a fantastic drug discovery machine” that churns out two to three clinical development candidates every year. The short-term value creation associated with the sale of commercial assets can be offset by the long-term value destruction associated with the unsuccessful merger of two R&D organizations, Actelion Chairman Garnier said during a subsequent analyst call. “There’s always this dark side to the transaction,” he said. Its avoidance, presumably, was one of the key elements in the protracted negotiations between the two companies. (See BioWorld Today, Nov. 29, 2016, and Dec. 15, 2016.)

“I would not have supported a deal where R&D discovery would have gone,” Clozel said. “This, for me personally, was absolutely essential.”

‘A STARTUP WITHOUT BEING A STARTUP’

Given the scale of the deal, J&J’s reluctance to assume the full carrying costs of the newco is understandable.

“This is the largest-ever transaction for Johnson & Johnson,” said Joaquin Duato, executive vice president and worldwide chairman of J&J’s pharmaceuticals division. Its previous biggest deal was its $19.7 billion cash-and-shares acquisition in 2012 of another Swiss firm, orthopedic devices maker Synthes.

Sourcing growth externally is nothing new, even if the scale of the present deal is exceptional. “Historically, it comprises about half of our growth, and we expect that to continue in the future,” J&J’s chairman and CEO, Alex Gorsky, told analysts.

Whether J&J is paying over the odds for Actelion is an open question for now. The big pharma said the deal will add about 1 percent to its long-term revenue growth rate and about 1.5 percent to 2 percent to its long-term earnings growth rate. Jefferies analyst Peter Welford had attached a “base case” valuation of more than CHF250 per share to Actelion. “We do not envisage any counterbids or competition concerns, with the takeout price above our base case CHF250+,” he wrote in an investor note. Its model does not attach any value to the R&DNewco assets at present – “but we would estimate a CHF5-10 per share enterprise value may be reasonable.”

J&J will retain Actelion’s presence in Switzerland, which will remain an important locus of expertise in ERAs, a drug class that it pioneered from the outset. J&J is already the largest U.S. employer in Switzerland, with some 6,000 people on its payroll. Much of the biotech industry interest will, however, transfer across to the new company, along with 600 to 700 of Actelion’s 2,500 employees.

It would be foolish to bet against Jean-Paul Clozel, long one of the key leaders of Europe’s biopharma industry, hitting another home run. He originally led a group of scientists who opted to leave Basel-based Roche Holding AG in 1996 and pursue development of Roche’s ERAs following the latter’s decision to terminate its interest in the area. He and his wife and fellow founder, the company’s chief scientific officer, Martine Clozel, according to legend, re-mortgaged their house to raise some seed capital. This time round, the circumstances are totally different.

“We are going to have a company that is a startup without being a startup,” he said. “Imagine a company with $1 billion in cash and 14 products in development.”

For those who’ve kept faith with original vision, the level of value creation has been very rewarding. Actelion debuted on the Swiss Stock Exchange on April 6, 2000, when it raised CHF246.6 million in an IPO priced at CHF260 per share. Since then, the stock has undergone two share splits, so investors who participated in the IPO are looking at a 14-fold return in less than two decades, in addition to several cash distributions along the way.